Interessieren Sie sich für Finanz- und Wirtschaftsnachrichten ?

Die Bank Bonhôte heisst Sie herzlich willkommen und stellt Ihnen Ihre Finanz-Experten gerne zur Verfügung.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.08 | 12'464.44 | 4'229.70 | 15'977.44 | 6'896.04 | 7'218.71 | 4'468.00 | 14'822.90 | 27'977.15 | 1'280.86 |

| Trend | |||||||||||

| YTD | 3.39% | -0.16% | 16.45% | 19.06% | 16.46% | 24.22% | 11.74% | 18.95% | 15.01% | 1.94% | -0.81% |

(values from the Friday preceding publication)

Main indices continued gaining last week in spite of pandemic-related angst and pricey share valuations, as inflation clocked in on expectations and the US Senate waved through the USD 1 trillion infrastructure drive. If the bill then passes through the House of Representatives, it will unleash an unprecedented amount of investment expenditure on roads, bridges and airports. Talking of roads, the road will probably be long before the 3.5 trillion welfare plan championed by the Democrats can make it over the finish line, given the plethora of amendments.

Much of the good news is already reflected in share prices. Yet the proportion of buy recommendations is hovering at its highest level in a decade, while solid earnings growth is powering a patchy short-term uptrend. The main markets have started this week in the red, pinned back by disappointing economic data out of China pointing to a slower economic growth. Meanwhile, the increasing chaos in Afghanistan, with the capital Kabul falling into the hands of the Taliban, is stoking geopolitical uncertainty. The flight to safety has been lowering government bond yields and sending the US dollar and the yen higher.

In the US, the consumer price index advanced by 5.4% year on year in July, in line with estimates. The core component, which strips out food and energy prices, was ahead by 4.3% year on year. However, the price growth in some hot segments such as second-hand cars has started to ease, rising by just 0.2% in the latest figures compared with upwards of 7% in previous months. This suggests that the inflation peak could be near, which if so would leave the Fed more time to extricate itself from its ultra-loose monetary policy.

Chinese retail sales – the bellwether for domestic spending – were up 8.5% in July, which was far less than expected. The slower growth number can be pinned on the rapidly spreading delta variant and the hit sustained by some local economies from natural disasters. Industrial production growth also cooled off, clocking in at +6.4%. In Japan, GDP rose by 0.3% in the second quarter but left the stock market impassive as the latter headed down on news of the spreading pandemic. A record number of coronavirus cases (20,000) was recorded for Friday and Saturday.

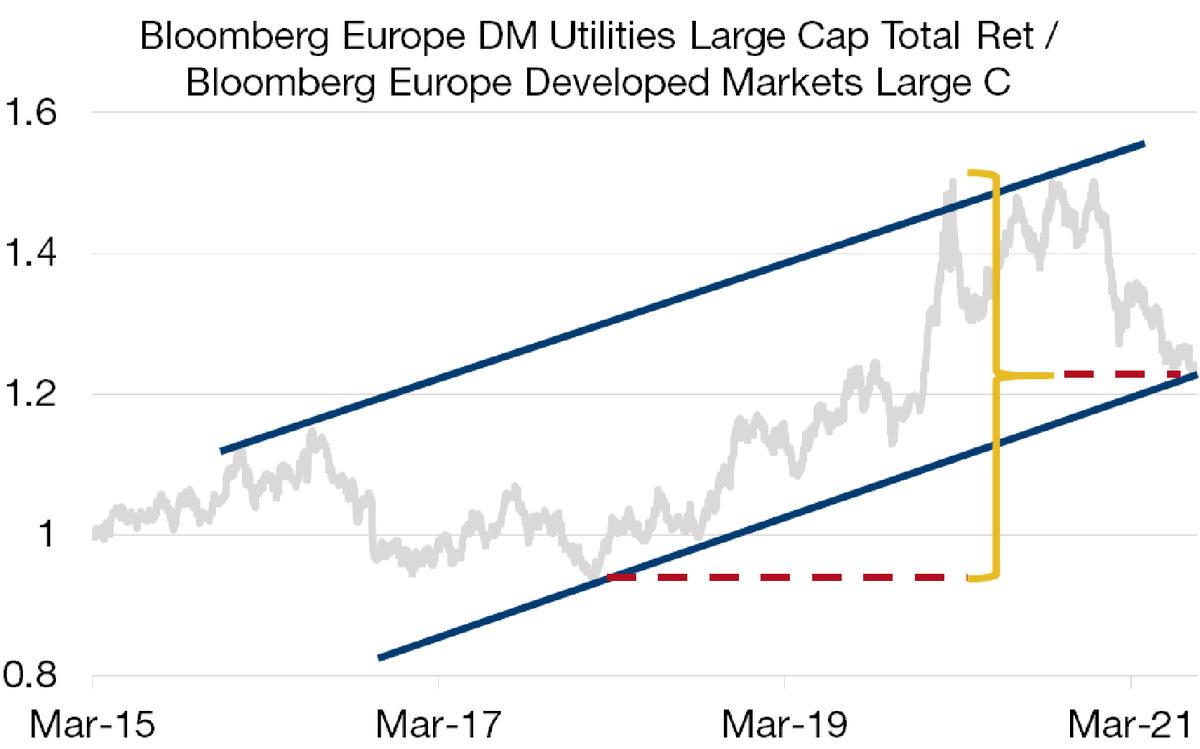

With most indices poised closed to all-time highs, it may be worth looking at sectors through a relative lens, in relation to their benchmarks. On a chart, this can show where there is out- or under-performance as well as highlighting opportunities for gaining exposure.

If we look at where the utilities sector is trading relative to the broad market, we can see that it is lagging both in the US and in Europe. In Europe, utilities has chalked up under-performance of 18% since mid-January. Globally, utilities are ahead by only 2% year to date whereas the broad metric is riding high upwards of 20%.

The utilities sector is made up of companies delivering public services such as power, water and gas supply. In Europe, it is currently trading on 16x estimated 2021 earnings whereas the broad market measure stands at over 20x. Because of its business, the sector is slightly more defensive than average. Its dividend yield is usually attractive, ranging from 3% to 6% for most companies.

The chart opposite indicates the performance of the sector relative to the broad European index. Looking at technicals, we can see that the utilities/market ratio has ebbed to the lower end of the channel, coinciding with 50% retracement of the major uptrend lasting from 2018 to 2020. Hence the current level should act as support. Our view is that utilities could well outperform the European broad index in the short/medium term.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.