L’actualité économique et financière vous intéresse ?

La banque Bonhôte est heureuse de vous accueillir et de mettre à votre disposition ses experts en matière d’actualité financière.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.95 | 0.99 | 11'045.49 | 3'924.84 | 14'431.86 | 6'644.46 | 7'385.52 | 3'965.34 | 11'146.06 | 27'899.77 | 943.01 |

| Trend | |||||||||||

| YTD | 4.66% | -4.98% | -14.21% | -8.69% | -9.15% | -7.11% | 0.01% | -16.80% | -28.76% | -3.10% | -23.46% |

(values from the Friday preceding publication)

Equity markets continued gaining last week, though modestly. The macroeconomic data reported was solid but comments from Fed brass dashed hopes for a quicker return to more accommodative monetary policy than was at the time expected.

This latest plethora of contradictory signals is undermining recently witnessed renewed confidence among investors. As a result, bond yields were relatively stable, with the US 10-year yield holding at around 3.8% and the Bund at 2%.

The slower rise in US producer prices, from 8.5% year-on-year in September to 8% in October, may have reinforced the feeling that the Fed might consider reducing the size of its next rate hikes. However, the stronger-than-expected increase in retail sales for October (1.3% and the same excluding the automotive and energy sectors) has awakened doubts in the minds of market participants.

Manufacturing output fell in October by 0.1%, dashing expectations for a modest 0.1% increase. Capacity utilisation was down at 79.9%, dipping from 80.1% in September, pointing to an ongoing economic slowdown.

The decline continued in the housing sector, with US existing home sales falling for the ninth consecutive month in October, specifically by 5.9% to a seasonally adjusted annual rate of 4.43 million units.

On the employment front, initial jobless claims for the week ending 12 November ebbed to 222,000 versus a forecast for 228,000. This shows the job market remaining in fine form.

The S&P 500 ended the week up by a 0.61% while the tech-heavy Nasdaq, more sensitive to interest rate expectations, gave up 0.27%. The Eurostoxx 50 jumped 2.21%, driven by bargain hunters and easing energy prices.

In Europe, the German ZEW economic sentiment indicator rose further in November. However, the economic outlook for the German economy remains bleak, while inflation is still a whopping 10.6% in the Eurozone.

US economic indicators out this week (e.g. PMI for November) and the minutes of the latest Fed meeting will once again be scrutinised by market participants.

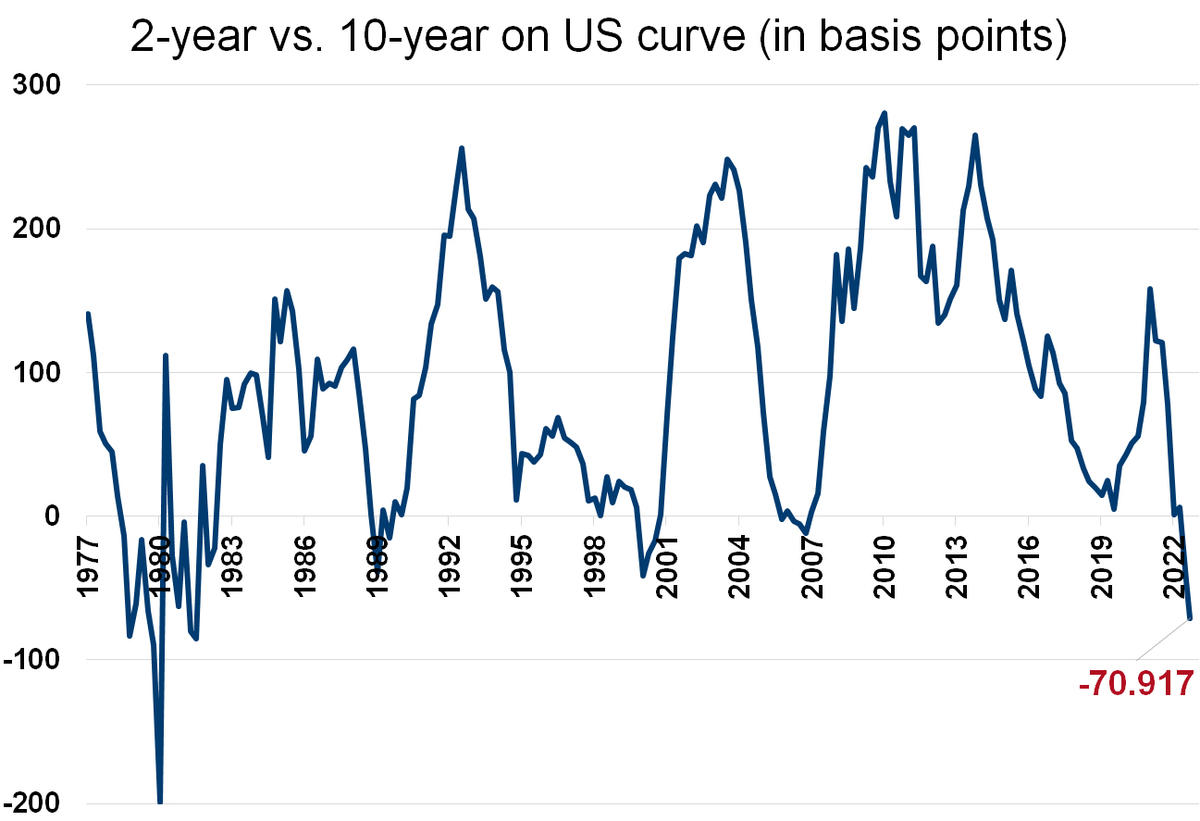

The current year has featured a return to positive yields and inversion of the US yield curve. Yields are trading at levels not seen for years, ranging from 1.51% to 3.80% for the 10-year bond and from 0.73% to 4.52% for 2-year paper. The two have peaked at 4.23% and 4.52%, respectively, this year.

The reversal on US Treasury yields – usually a signal of recession – has reached historic proportions, with last week’s 2-year yield 72 basis points higher than the 10-year yield. This is the widest spread in four decades.

More worryingly still, the 10-year yield has held at a level below the 3-month Treasury Bill for the past two weeks, a phenomenon that has preceded each of the last eight recessions starting from 1979. The inversion on the yield curve indicates that the Fed is being too hawkish in its monetary tightening, as testified to in speeches by various Fed governors last week. James Bullard, President of the St Louis Fed, said that rates need to rise into a range of 5-7% to curb inflation while warning of the risk of further financial stress. His words erased any hope of a sudden pivot by the US central bank and prompted markets to revise rate expectations upwards. The terminal rate priced in now lies between 5% and 5.25%, compared with 4.75% previously.

By past standards, the yield curve suggests that the world’s foremost economy stands on the verge of recession. It’s now the Fed’s job to ensure, as best it can, that this will be short-lived.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.