Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.90 | 1.09 | 11'570.68 | 4'089.38 | 15'692.90 | 6'515.66 | 7'069.04 | 4'229.89 | 13'814.49 | 28'941.52 | 1'381.56 |

| Trend | |||||||||||

| YTD | 1.61% | 1.15% | 8.10% | 15.11% | 14.39% | 17.37% | 9.42% | 12.61% | 7.19% | 5.46% | 6.99% |

(values from the Friday preceding publication)

Equity markets gained ground last week, particularly in Europe, on the back of better macroeconomic data across the board. The services sector improved its showing as lockdowns and other restrictions were eased. Sector wise, energy – helped by the 4.5% increase in crude prices on confirmation of OPEC production cuts – and automotive were particularly firm. Financials and tech were moreover helped by a downswing in bond yields, with the US 10-year yield dipping to 1.57%. We believe that the stronger recovery in European equity markets is set to continue, underpinned by the estimate for 50% earnings growth this year, indices’ highly cyclical compositions and more attractive valuations compared with US equities.

Despite firmer macroeconomic indicators than expected, in turn boosting the prospect for higher interest rates, the spectre of inflation has been waning of late. It looks like central banks have succeeded in reassuring the markets of their willingness to keep policy nice and lose for the foreseeable future. The US employment report for May showed 559,000 new jobs, which in other circumstances might have caused an upset given that the forecast was for 671,000 (the unemployment rate fell to 5.8%). Yet the lower-than-expected data has cooled expectations of imminent monetary policy tightening. The Fed is starting to unwind the corporate bonds facility put in place in March 2020 and will start selling down the fixed-income ETFs and corporate bonds it has acquired. But the amount of these sales is meagre, amounting to around USD 5 billion in corporate bonds and USD 8.5 billion in ETFs on a balance sheet approaching USD 8 trillion. The ECB, which meets on Thursday, is meanwhile expected to revise its GDP growth outlook upwards amid record business indicators and imminent plans to launch the European stimulus fund. However, it will probably stick to its accommodative monetary stance as the current economic-recovery phase requires strong support.

G7 members this weekend agreed to a minimum tax rate of 15% on corporate profits. Under these plans, countries will be given the right to tax profits wherever they are generated. The OECD estimates that this could generate between USD 50 billion and 80 billion in additional tax revenues per year. After this basic agreement, aimed mainly at closing the loopholes that multinationals have been exploiting to reduce their tax bills, the road to genuine global tax reform will still be long.

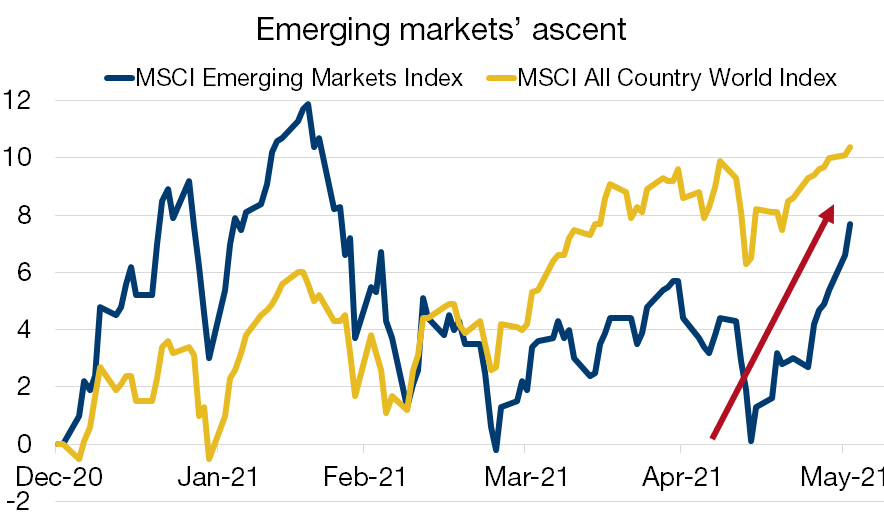

Emerging economies are benefiting from both the global recovery and the weaker dollar. In May, the MSCI Emerging Index was lifted by a renewed risk appetite among investors, who hoisted it back to the uptrend line last seen in February.

China – where the recovery has been stronger and which dominates the EM index – is largely responsible. The Chinese equity market has rallied strong recently, pushing its market capitalisation to USD 12 trillion, which is 55% higher than when the pandemic began in March 2020. Supportive fiscal and monetary policies together with ample liquidity have fuelled the economic recovery and strengthened the yuan, driving the value of Chinese equities higher since last October, when the index hit USD 10 trillion for the first time since 2015. While some of the market value stems from new listings and the total amount is still a far cry from America’s USD 48 billion, China’s recent market-cap numbers have sent EM indices soaring.

The current business environment and the significant growth differential tilted in their favour are helping emerging economies. The prospects for returns, plus the attractive valuations compared with developed economies, are likely to continue luring fresh capital. In particular Asia, which already represents 80% of global EM indices’ weightings, is benefiting most from the recovery in world trade, thanks notably to the November 2020 trade treaty uniting 15 Asian countries representing 30% of world trade.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.