BONHÔTE (CH) - Swiss Gold Bars ESG

The BONHÔTE (CH) - Swiss Gold Bars ESG fund offers investors the opportunity to invest in physical gold stored in Switzerland, sourced from mines that comply with ESG standards. The fund sidesteps artisanal mining risks by exclusively investing in large-scale mining operations that adhere to national regulations with stringent environmental and ethical standards.

Objectives

Financial

Replicating – through passive management – a performance on a par with the gold price by investing directly in physical gold (in the form of ingots and bars) stored in Switzerland.

Non-financial

Resolve traceability and transparency issues in gold supply chains by selecting mining companies that apply ESG criteria and manage their mines responsibly.

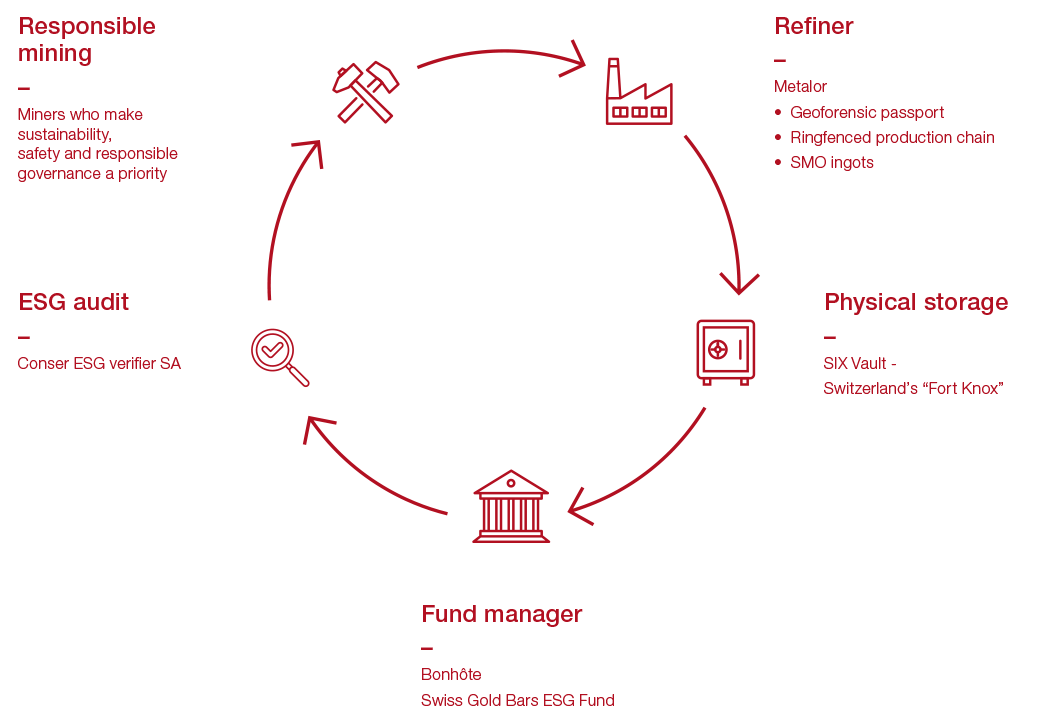

The fund ensures full transparency throughout the supply chain, from extraction to the final investment stage. Each link in the supply chain is carefully selected and the relevant information disclosed, allowing investors to gain a clear understanding of the provenance of the gold and how the mining company implements ESG in its operations.

Each ingot is fully traceable, originating from a single mine (Single Mine Origin – SMO).

The Bellevue Gold Project has been specifically selected for its commitment to responsible mining practices and reducing its carbon footprint. The company ranks as a significant player in the gold industry, producing more than 6 tonnes of gold per year.

Other mines that meet similar criteria may be selected in the future provided they measure up to the fund’s ESG requirements.

The gold is transported and refined by Metalor along a fully ringfenced chain of production.

To provide complete traceability, the fund uses the geoforensic passport, which verifies the exact geographical origin of the gold by analysing its chemical composition. This scientifically validated process – developed by the University of Lausanne in collaboration with Metalor (and co-funded by the Swiss government through lnnosuisse) – delivers an extremely reliable level of traceability.

The additional cost of approximately 0.4% of the total value incurred by the traceability process and gold storage in Switzerland is outweighed by the full assurance of transparency and maximum security for investors.

Total traceability and transparency – from mining to minting

Selection and ESG assessment

Selection using ESG screening

The fund manager carefully selects the companies in the value chain with a view to minimising ESG risks. We give preference to companies that mine gold responsibly and which have made ESG criteria pivotal to their operations and corporate strategy. The concept of governance is also considered because of its connection to sustainability. Each entity is required to have a transparent business structure and clearly defined responsibilities to ensure that ESG commitments are met.

The transition to clean energy today means encouraging industries adopt more responsible production methods, and mining is no exception. The fund prioritises those mining companies that are actively reducing their carbon footprint. The companies selected have an obligation to report on carbon emissions (under scopes 1 and 2) in line with global standards, e.g. the Green House Gas Protocol.

As part of this process, the manager uses a best-in-class approach based on peer-group comparisons of ESG performance. Only those whose ratings exceed a pre-defined hurdle are deemed suitable to supply physical gold. To gain further insight, supplementary data from external sources is used to guarantee that the assessment is impartial and comprehensive.

Exclusions

Companies that also operate in sectors deemed sensitive such as conventional arms, tobacco, alcohol, gambling, pornography, genetically modified organisms and nuclear energy, or those embroiled in significant controversies pertaining to the principles enshrined in the United Nations Global Compact and other international conventions, are excluded from the physical gold supply chain.

ESG audit

The portfolio ESG assessment is conducted in accordance with the proprietary ESG Consensus® Methodology, from Conser ESG verifier SA, a Swiss sustainable investing consultancy. This methodology screens best-in-class investments using the opinions of key players in the SRI industry, then assigns an ESG rating to each investment. Rating trends affecting mining companies are monitored by the fund manager. If a rating drops below a set threshold (ESG Consensus® Rating of B or higher on a scale of A+ to D), the mining company in question is excluded from the supply chain.

Benefits

Portfolio diversification

Gold has a low correlation with other financial assets, making it ideal for diversifying and reducing overall portfolio risk.

Kept safe in Switzerland

The gold (ingots and bars) is stored safely in Switzerland at the SIX Vault facility..

Physical gold holdings

Each unit in the fund is backed by a specific quantity of physical gold, making this a tangible investment to all intents and purposes. No derivative financial instruments are used.

Redemptions in kind

The fund offers investors the flexibility to redeem their gold in kind and take physical delivery of their investment, in accordance with the terms set out in the fund agreement.

Full supply chain transparency

The fund ensures full transparency at every stage of the supply chain, from extraction to storage. All the companies involved are required to report on their activities.

Single Mine Origin

The origin of each ingot or bar can be traced back to a single mine, providing transparency and enabling sourcing from mines that adhere to responsible practices.

Scientific-grade traceability

The geoforensic passport process uses chemical analysis to verify the exact geographical origin of the gold.

ESG criteria inclusion

Partner mines are selected according to exacting criteria to guarantee the highest standards of human rights observance, health and safety, and environmental management.

Carbon emission reductions

The fund collaborates with mining companies that are committed to reducing their carbon emissions and have demonstrated a lower carbon intensity than their industry peers.

Brochure

Contact us

Investment funds

We apply the same values in developing and managing investment funds as we do in all our endeavours. The freedom to reflect and to act, inherent in our status as an independent bank, enables us to actively seek new investment themes and to develop them rapidly – often away from the crowd.