Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

Gold’s rise has been powered by a whole series of factors. First of all, central banks have played a major hand in it, especially those in the BRIC countries (Brazil, Russia, India and China). In a bid to reduce their reliance on the US dollar, they have set about buying gold in vast quantities. Reflecting this, annual demand for gold between 2022 and 2023 exceeded 1,000 tonnes – double the 2021 level and quadruple the 2020 level. These institutions are increasing the proportion of their foreign exchange reserves held in gold. Some of them are worried about possible dollar depreciation. Others are more concerned about the political firepower wielded by the greenback.

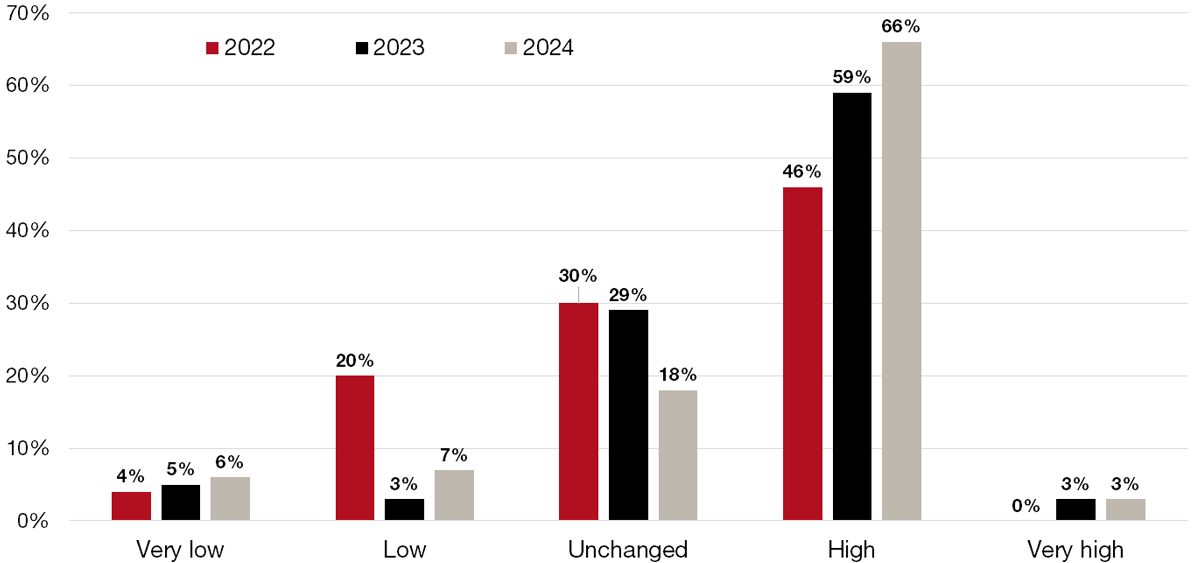

The World Gold Council’s 2024 survey of central banks’ gold reserves shows that central banks are bullish about gold’s status as a reserve asset. Close to 70% of respondents expect gold’s position in central bank reserves to increase over the next five years.

Inflation triggered by the post-pandemic economic rebound, supply-chain disruption caused by the renewed lockdown in China and the surge in commodity prices sparked by Russia’s invasion of Ukraine, prompted the central banks in developed nations to hike their benchmark rates substantially between February 2022 and August 2024. Even though these rate hikes tend to weigh on gold prices, again because it does not pay any interest, gold maintains its appeal as a means of safeguarding portfolios against monetary erosion. Interest rates are now moving lower again, as central banks look to support economic activity. With the emergence of a cycle of rate cuts, other factors supporting gold prices have appeared.

Projected growth in central bank gold reserves (5-year forecasts).

Although gold evidently pays out zero yield, it’s the ultimate safe haven, as it has shown time and again throughout history. So it’s tremendously sought-after in times of crisis. And at the present time there’s no shortage of crises. There’s the war in Ukraine, the conflict in the Middle East, the tension surrounding Taiwan and North Korea’s escalating provocations. Granted, gold prices sometimes decline or tread water, but over the past 50 years even bigger rallies have always followed in the wake of such episodes.

Another factor influencing gold prices is the brisk demand from the jewellery industry. According to estimates, it consumes more than 2,000 tonnes p.a. and remains the dominant segment, accounting for 46% of total demand for gold in the third quarter of 2024. Gold is usually bought and sold in US dollars. In addition, whenever one factor works against gold prices, others tend to push in the opposite direction. Demand for jewellery weakened in 2024, but investors picked up the slack. This was particularly the case in China, where the lower demand for jewellery was partly offset by a sharp increase in investment in gold ingots and coins. Gold ETFs also attracted major net inflows from China, lifting the combined total in 2024 to a record high.

Gold remains a key pillar of resilient and diversification-based investment strategies.

Gold’s enduring appeal has prompted us to launch the Bonhôte (CH) – Swiss Gold Bars ESG Fund. The advantages of this physical gold fund include its increased security, scientific-grade traceability and ESG integration. The fund’s gold, held in Switzerland, originates from mines meeting the highest environmental, social and governance (ESG) standards. It is operated in conjunction with Metalor, a precious metals refining and processing company founded in Neuchâtel back in 1852.

Bonhôte is pleased to announce the appointment of Kim-Andrée Potvin as its next Chief Executive Officer (CEO) from 1 January 2025. She will take over from Yves de Montmollin, who after 20 years with the Bank – including half that time spent as CEO – will join the Board of Directors, becoming its Vice-Chairman in April 2025.

Tuesday 10 December 2024 will go down in history for Bonhôte-Immobilier SICAV. The foundation stone was laid today at the Concept B.180 development, with officials from the city and canton of Neuchâtel in attendance. This event marks the start of construction work.

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.