Megatrend Equity ESG

Bonhôte Strategies

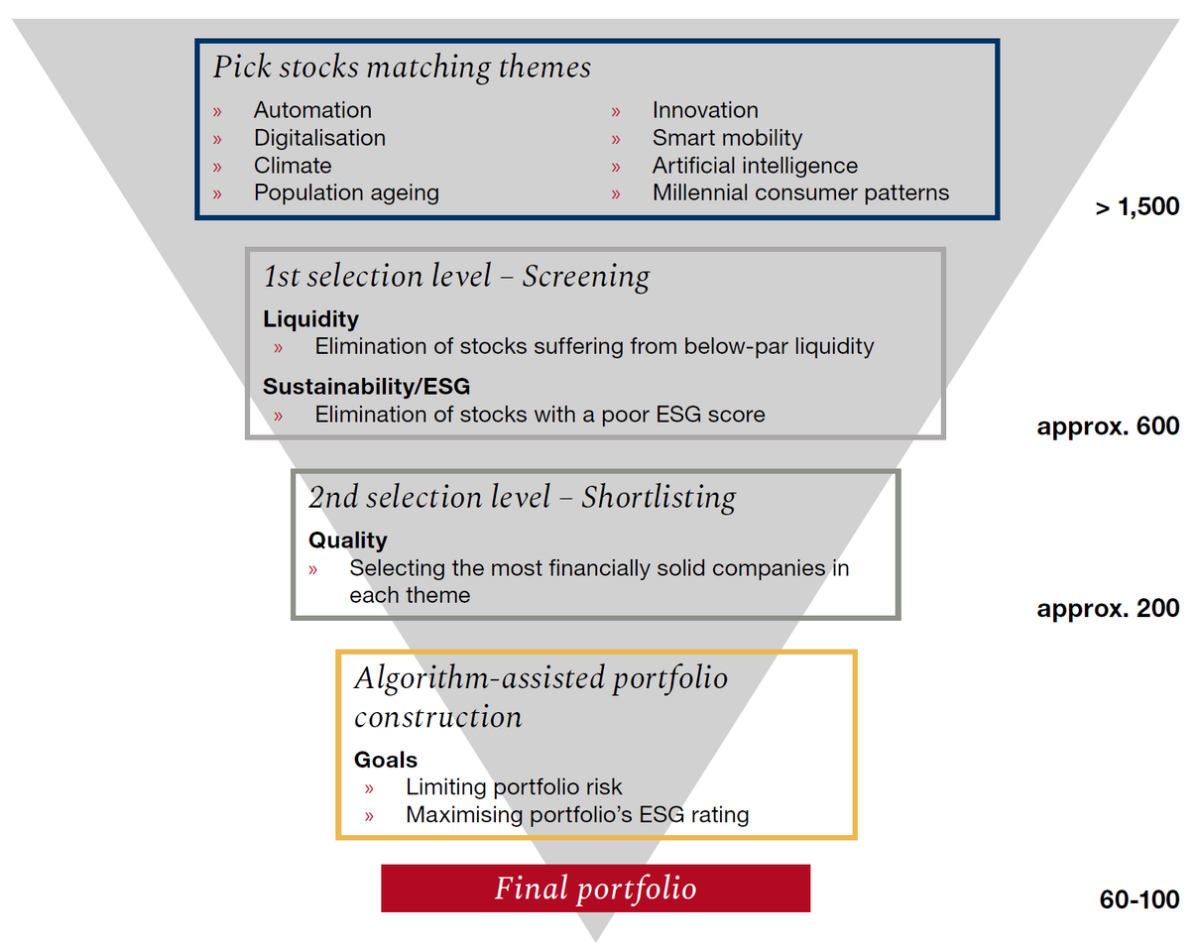

This fund invests in future-facing themes while optimising the portfolio’s ESG rating.

These themes are tied to underlying and structural shifts in our societies, lifestyles and consumer habits.

These shifts are affecting the vast majority of the global population.

The companies selected by the fund are positioned to gain from these profitable trends over the long term.

Video

Investment universe

Automation

50% of jobs could be automatedClimate

$755 billion invested, rising by up to sixfold out to 2030Digitalisation

Growing 2.5x faster than global GDPPopulation ageing

2.1 billion over 60 by 2050, equating to 21.8% of the populationInnovation

Driving the changeSmart mobility

Market worth over $1 trillion by 2030Artificial intelligence

Market outweighing the combined GDP of India and China by 2030Millennial consumer patterns

Millennials and their progeny to represent 72% of the global population in 2030

Investment philosophy

Investing in future-facing companies

Companies helping drive structural change are positively exposed to long-term growth trends. Megatrend combines investments across several themes to obtain:

- better diversification

- a more resilient portfolio

Selected for their high-quality balance sheets

Companies with excellent financial strength tend to outperform the market over the medium/long term.

Complying with the most stringent ESG standards

Focusing on companies demonstrating best practice in ESG adds value and reduces portfolio risk.

Meticulous portfolio construction

Brochure

Contact us

Investment funds

We apply the same values in developing and managing investment funds as we do in all our endeavours. The freedom to reflect and to act, inherent in our status as an independent bank, enables us to actively seek new investment themes and to develop them rapidly – often away from the crowd.