Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 1.00 | 1.09 | 9'827.72 | 3'446.71 | 12'012.81 | 5'488.32 | 7'155.38 | 2'952.01 | 7'982.47 | 21'410.20 | 996.58 |

| Trend | |||||||||||

| %YTD | 1.45% | -3.08% | 16.59% | 14.84% | 13.77% | 16.02% | 6.35% | 17.76% | 20.30% | 6.97% | 3.19% |

Financial markets last week continued to ebb and flow in response to the usual considerations. Concerns over the state of global economy were relieved alternately by signs of possible breakthroughs on China-US trade talks, then by the belief that central banks will rush to the rescue, whatever happens.

Last week was rough for equity markets, driven down by evidence pointing to a brutal deterioration in the global outlook for economic growth. The latest set of manufacturing PMIs sharpened fears of a recession.

Globally, the manufacturing PMI is situated at 49.7 – a whisker below the line marking expansion. Now the signs of slowing output are starting to contaminate the services sector as well. The release of the ISM US non-manufacturing PMI, which plunged to 52.6, put the wind up investors, even though such a reading is perfectly compatible with GDP growth of 1.5-2% in the US during the third quarter. Once again, hope of even looser monetary policies, featuring another rate cut by the Fed the next time it meets, restored stability to stocks, which were able to recoup some of their losses last week.

Fed chief Jerome Powell made some reassuring noises, admitting that a risk hangs over growth, but that the economy is still in fine form. Non-farm payrolls, released on Friday, provided further relief to investors as job creation clocked in only slightly below estimates at +136,000. Moreover, the rate of unemployment dipped by -0.2 of a percentage point to 3.5% – its lowest level in 50 years. The most calming influence came from the pedestrian wage growth (+2.9% year on year), signalling that inflation is still ticking along short of expectations and thus allowing the Fed to continue cutting rates.

Trade talks are due to resume between China and the US on Thursday and Friday, with the visit of vice-premier Liu He to Washington. There seems to be slightly more urgency in the mood, although rumours have suggested that the Chinese have scaled back the scope of any potential agreement.

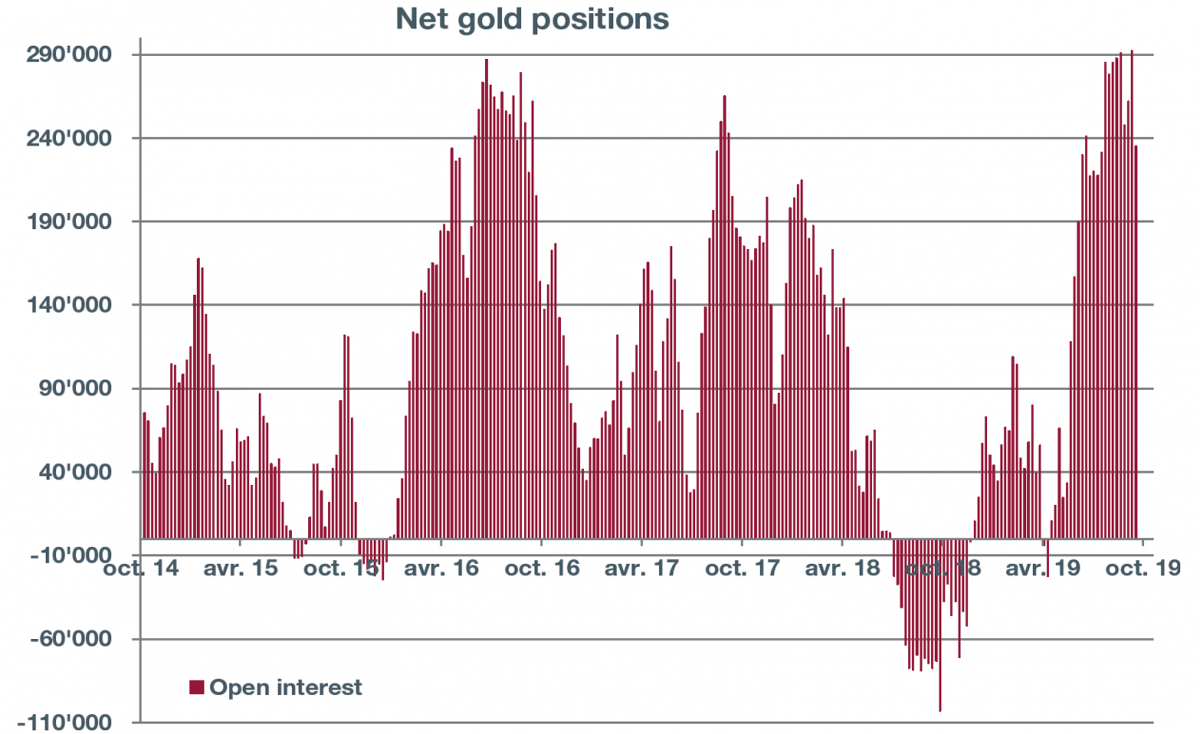

Gold seems to be a favourite with investors at the moment, judging by the high level of net positions in recent weeks (see above chart).

The metal has plenty of advantages that are winning over market participants, starting with its haven status. When financial markets are gripped by turbulence and the risks rise, the normal reaction – as during a storm – is to find a safe haven. In times when investors are dialling down their positions in equities, gold is a decent alternative to cash.

Making gold increasingly attractive today are the negative yields blighting holdings of CHF and EUR. The main drawback to have gold as opposed to cash was that it did not pay interest. These days, the opportunity cost of having gold in portfolios has even swung negative for investors reasoning in Swiss francs or euros.

Another advantage relative to conventional currencies is that the value of gold cannot be tampered with by central banks. Devaluations aimed to kick-starting economies can even be positive. For example, dollar depreciation automatically nudges up the price of gold per troy ounce, quoted in dollars.

Exposure to gold can be obtained efficiently through exchange-traded funds (ETFs).

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.