Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.94 | 1.06 | 9'736.82 | 3'232.07 | 11'541.87 | 5'139.11 | 6'462.55 | 2'972.37 | 8'575.62 | 20'749.75 | 1'012.08 |

| Trend | |||||||||||

| %YTD | -2.93% | -2.48% | -8.29% | -13.70% | -12.89% | -14.03% | -14.32% | -8.00% | -4.42% | -12.29% | -9.20% |

Coronavirus has become the bane of investors’ existence in recent weeks. Another thing that they did not see coming (referred to by some as a ‘black swan’) has been the plunge in the price of oil.

Fears of a pandemic have led several countries to lock down entire areas of their countries, with economic output grinding to a near-halt as a result. Many governments have unveiled emergency budgets. Fears of recession have gained traction, sending investors scurrying into government bonds and gold. Since mid-February, when the coronavirus broke free from Asia, the mood of uncertainty in financial markets has steadily worsened. The volatility index on the S&P500 has surged to almost 50. Shares have been hit by panic selling. Banking shares, especially European banks, are facing a sell-off reminiscent of the 2008 financial crisis and the aftermath of Lehman Brothers.

All it took was the tiff between Russia and Saudi Arabia, on the subject of production cuts in support of oil prices, to send markets up in flames. Saudi Arabia, whose production cost is far lower than others, has opted to fight back by opening up its pipelines, effectively triggering a price war. The price of crude has shot down by almost 30%, its biggest intraday decline since the first Gulf War. The ramifications are huge for several countries and industries. The price plunge has upset financial markets, dragging down global market indices and driving extreme fluctuations in exchange rates. The yen and the Swiss franc are appreciating and the US dollar is retreating while – worse still – the rouble and the Mexican peso are nosediving. The yield on the 10-year Treasury has slid below 0.5%.

Even though demand for crude oil will decline, this price move is overdone as not many market participants are gaining from it. In this setting, the Chinese equity market is holding up relatively well despite a 17% drop in exports in the first two months of the year.

Amid the chaos, solid US job figures for February came and went largely unnoticed. A further 273,000 jobs were created in February, matching the revised figure for January. This was far ahead of estimates. The unemployment rate dipped to 3.5%, its lowest level in half a century. However, many investors think that the coronavirus threat will slow business in the months ahead.

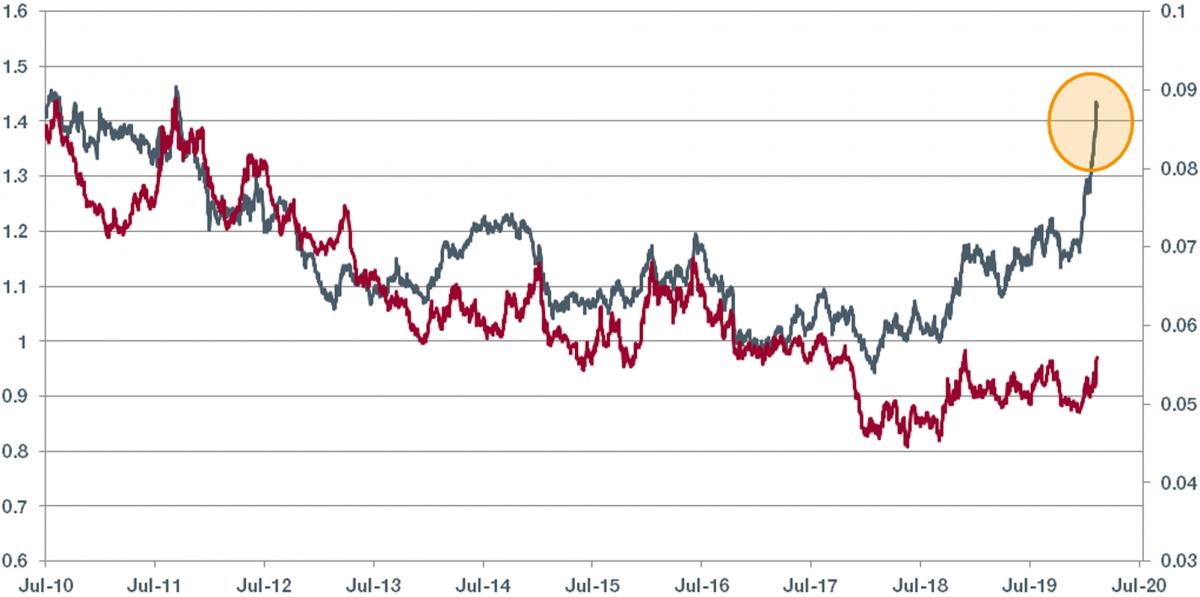

European utilities (gas and power providers) have been back on vogue for the past two years or more.

The sector had not been growing much and was in investors’ bad books for more than eight years, eclipsed by cooler sectors such as tech stocks, whose growth rates were far superior.

Over those eight years (from late 2009 to late 2017), European utilities underperformed the broad European index by more than 6% annually. German companies in particular were hurt during this time by the decision to shut down nuclear power in Germany and the associated wave of restructuring.

But in early 2018 the trend in Europe was reversed. Utilities – seen as a defensive sector with low exposure to economic trends – turned the corner. Since early 2018, the sector has beaten the broad European index by more than 40%, equating to annual outperformance of over 17%.

This move is not particularly perceptible in the US, where utilities have only marginally outperformed the main index in the past two years. But things could change.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.