Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.09 | 11'999.70 | 4'120.66 | 15'607.97 | 6'622.87 | 7'136.07 | 4'280.70 | 14'360.39 | 29'066.18 | 1'379.59 |

| Trend | |||||||||||

| YTD | 3.63% | 1.20% | 12.11% | 15.99% | 13.77% | 19.30% | 10.46% | 13.97% | 11.42% | 5.91% | 6.84% |

(values from the Friday preceding publication)

Equity indices have soared to new records. In the US, stocks were buoyed last week by Jerome Powell’s dovish tone plus the announced bipartisan deal on infrastructure spending together with strong results by banks from their annual stress tests. If the world came to be blighted by a severe global recession affecting commercial real estate, corporate debt and employment levels, their capital buffers would be almost double the minimum required. Dividend payouts and share buybacks can therefore be resumed on 30 June. In Europe, indices rose modestly as investors took a more cautious tack during the week amid the spread of the new ‘delta’ variant. Sector wise, commodity-related stocks made strong advances. Oil companies were boosted by a rise in the price of crude upwards of 3%.

Fed chair Jerome Powell said in his congressional testimony on the state of the US economy that the authorities would bide their time before ending their ultra-loose monetary policy. This gave rise to renewed optimism among investors. Inflation is being fuelled by a handful of business categories affected by the reopening of the economy, while companies struggling to hire should find it easier to find employees in the remainder of this year. Job creation in May, out this Friday, is estimated at 700,000 additions. The average year-to-date number is 535,000. At that rate, it would take until the autumn of 2022 to return to pre-pandemic levels, which argues for keeping interest rates nice and low.

Investors welcomed Joe Biden’s announcement of a bipartisan agreement with a group of ten Republican and Democratic senators for a five-year USD 1 trillion infrastructure plan, including USD 579 billion in new spending. A large part of the expenditure is earmarked for transportation, including upgrades to the road network, bridges and airports, and for developing power infrastructure and broadband, all of which would provide a small boost to GDP growth by supplying extra income to construction and manufacturing companies. Whether this will clear the Senate is not certain, as the Democrats want a separate plan for social infrastructure (health and education). Financing – which is still unclear – is probably the biggest obstacle. There has been talk of reducing the backlog of unpaid taxes by hounding tax evaders, or using some of the funds released for the pandemic. At this juncture, the red lines of each party, such as higher taxes for companies and the middle class, have not been touched upon.

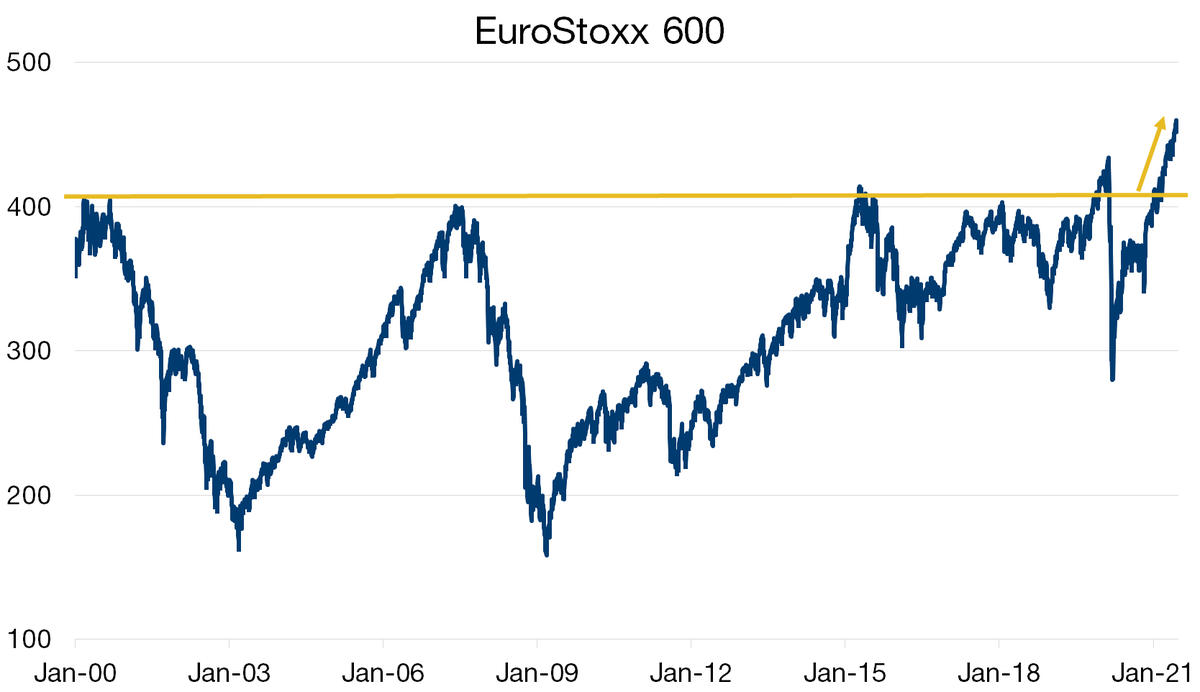

There’s no stopping the Stoxx Europe 600 (total return +16.7%), which has reached highs not seen since 2002. Part of the reason for these gains has been the end to business lockdowns and the economic upturn. In addition, national-government payouts from the NextGeneration EU stimulus bazooka, which could total as much as EUR 750 billion, are due to begin in July. This is bound to give European equities an extra lift in the period ahead of us.

Banks, electric vehicle manufacturers and the industrial sector have been the big winners, whereas many ‘covid stocks’ have fallen out of fashion. Online casino operator Evolution AB plus Porsche and Banco de Sabadell are among the top performers in this year’s Stoxx Europe 600 index. In contrast, gainers from the pandemic such as Just Eat and TeamViewer have seen a reversal in their strong 2020 performances.

These swings embody a shift in behaviour among investors, who have lowered their defences relative to 2020 and developed a certain appetite for risk. Sectors benefiting from the post-pandemic recovery, such as banking, automotive and construction, have led the way. Utilities is the only sector in Europe to have lost ground.

Value stocks, driven by the momentum of European economic activity, are set to continue outperforming. The ECB is not yet ready to raise rates nor tone down its asset purchases and the aid package, which unlike the US stimulus is not pro-cyclical but aims to modernise Europe. All of this represents additional arguments in favour of European equities.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.