Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.97 | 1.05 | 9'665.35 | 2'908.11 | 10'904.48 | 4'549.64 | 5'935.98 | 2'929.80 | 9'121.32 | 20'179.09 | 911.65 |

| Trend | |||||||||||

| %YTD | 0.49% | -3.06% | -8.96% | -22.35% | -17.70% | -23.89% | -21.30% | -9.32% | 1.66% | -14.70% | -18.21% |

Risk assets continued recovering last week as investors disregarded lousy economic data, the mixed bag of first-quarter earnings releases and renewed bickering between China and the US. Companies also slashed guidance. The consensus now forecasts a 50% plunge in European corporate earnings for the second quarter. Last week the S&P 500 was up 3.5% and Nasdaq gained 6%. In Europe, stock markets were broadly unchanged, pinned back by widely divergent data and investors’ appraisals of the various national plans to ease lockdown restrictions.

In the US, the Bureau of Statistics released the worst employment report in a century, showing the unemployment rate soaring to 14.7%. A total of 20.5 million jobs were destroyed in April. To put this figure in perspective, companies shed a combined 17 million jobs during the last seven recessions. The latest surge in the jobless rate came despite the USD 700bn from the Paycheck Protection Program, aimed at keeping employees on the payroll. Reassuringly, for the vast majority of the newly unemployed (78%), their status is likely to be temporary.

Concurrent with the pandemic, the weightings of big tech in the S&P 500 – which had already been increasing during the pre-coronavirus era – have risen further. Social distancing measures and smart working have produced a kind of ‘surviving of the fittest’ mentality as investors consign travel & leisure groups, airlines and oil refiners to the evolutionary dustbin.

At the week begins, confidence in ‘Phase 2’ of the China-US trade deal and expected further monetary stimulus from Chinese authorities are leading equity markets higher. Countries around the world are proposing their own plans for easing lockdowns. Meanwhile European vehicle sales seem to be stabilising after dipping by only 5.5% in April. The Eurozone agreement reached on Friday offering loans at preferential rates for member countries to finance their fight against the coronavirus is also having a positive effect.

Regarding monetary policy, the People’s Bank of China has said it wants to use tougher stimulus policies to counter the dampening effect of the pandemic on economic growth. This coming Wednesday Fed Chairman Jerome Powell’s speech on the state of the economy will be watched closely to see if he moots the possibility of negative rates – an option that the Fed has so far rejected but which the market seems to favour, given the route that yields are currently taking.

The pharma sector has outperformed the broad market by more than 12% year to date, boosted by speculation over who will win the race to develop a Covid-19 vaccine and a reliable diagnostic test.

Investors are probably buying hot air, though, as many unknowns still exist. Will the potential vaccine arrive in time or only after the desired ‘herd immunity’ has been achieved? Will the virus have mutated or perhaps more or less vanished from the scene by the time the drug becomes available? Will production capacity be sufficient in the timeframe? These and so many other questions make predicting the potential revenue streams a haphazard exercise.

Most likely the final amount will represent only a fraction of the revenues reported by the largest groups in the running. The main unknown remains the number of companies that can bring a product to market. Provided this can actually be achieved, there will undoubtedly be more than one winner. China, the US and Europe have all entered the race, betting on more than 120 projects in total – at least 10 of which have already entered clinical trials.

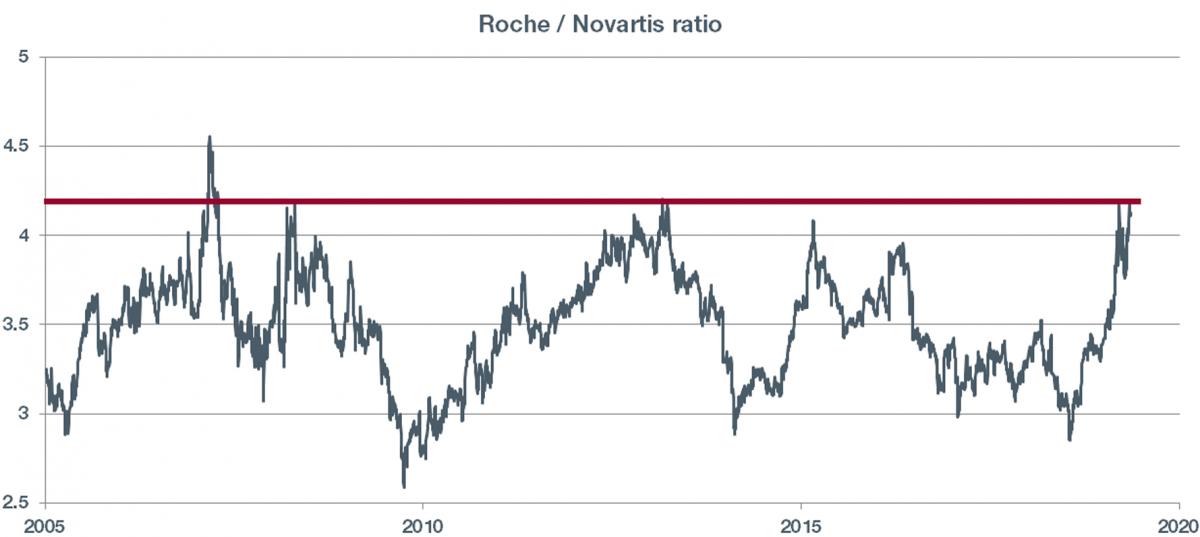

All this speculation has hoisted the Roche/Novartis ratio to an attractive level for rotating into Novartis. The P/E differential has narrowed to 2 points (15.5x for Roche versus 13.5x for Novartis).

Roche may be participating in the diagnostics race. However, Novartis is still buying back shares, with the aim to repurchase approximately 10% of the equity, and this is providing strong support for its share price. On current multiples, we advise picking Novartis ahead of Roche.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.