Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.96 | 1.07 | 9'831.49 | 3'050.20 | 11'586.85 | 4'695.44 | 5'935.98 | 3'044.31 | 9'489.87 | 21'877.89 | 930.35 |

| Trend | |||||||||||

| %YTD | -0.62% | -1.65% | -7.40% | -18.56% | -12.55% | -21.46% | -21.30% | -5.77% | 5.76% | -7.52% | -16.54% |

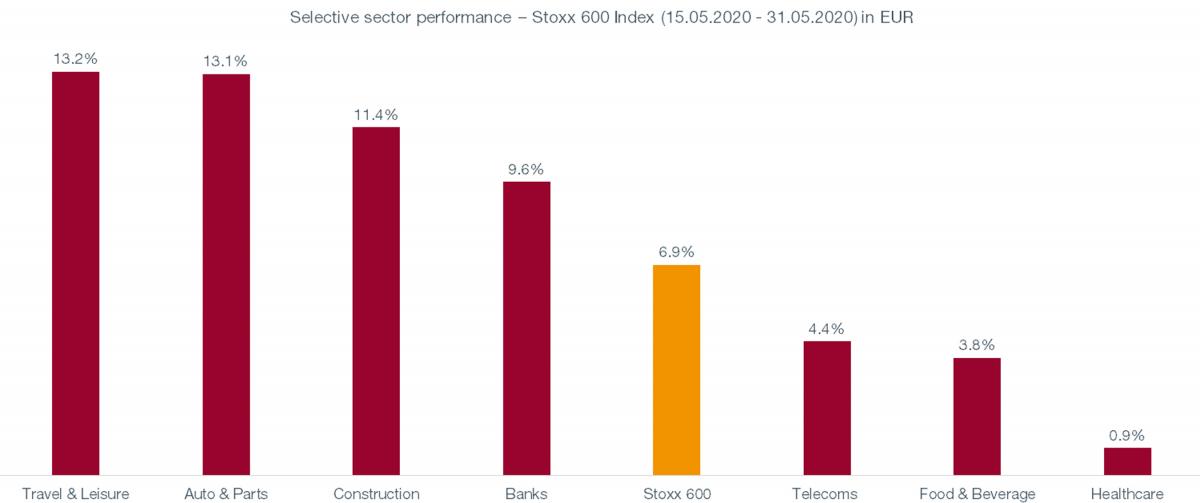

Equity markets continued to trend upwards last week. In recent weeks we have also seen a recovery in those sectors and stocks that underperformed during the lockdown period, such as cyclical manufacturers, travel & leisure and banking. We’ve also witnessed rotation out of ‘growth’ into ‘value’, and this has been pinning back tech stocks recently. The rhetoric is worsening between Washington and Beijing, which has apparently asked publicly owned companies to stop buying soybeans and pork from the US. Investors are ignoring the bluster for now, despite the foreseeable fall in corporate profits. All in all, the watchword last week was ‘Don’t fight the Fed’.

This week markets are firm ahead of two key events: the ECB meeting on Thursday and the US employment figures for May on Friday. Investors expect the ECB’s asset-purchasing plan (Pandemic emergency purchase programme, or PEPP) to increase from EUR 500bn to EUR 750bn and be extended beyond December 2020, with income from maturing securities reinvested. In the US, an unemployment rate of 19.5% is expected, reflecting 800,000 further job losses in May.

In Europe, manufacturing PMIs last week kindled hopes of a growth recovery after improving sharply month-on-month in May as lockdowns were ended, despite remaining a poor show in absolute terms. For the Eurozone, the PMI rose to 39.5 while the Italian PMI actually surged to 45.4. In the US, the manufacturing ISM stood at 43.1. China’s manufacturing PMI rose to 50.7, scraping into expansion territory.

The European Commission has published its fiscal blueprint for the recovery under which EUR 750bn of funds, equivalent to 5.4% of EU GDP, would be doled out. The loans would be targeted at those countries most in need. Countries with a high debt-to-GDP level, such as Italy, would be able to access cheaper financing than on the market. This proposal, if unanimously approved by the 27 Member States, would mark a significant step forward towards European integration. But the so-called ‘frugal four’ (Austria, Denmark, the Netherlands and Sweden) are expected to request changes.

The war of words with China as well as the violence and divisions seem to be aiding Donald Trump’s re-election campaign. Regarding China, the president sees it in his interest to act firmly, considering that polls show 68% of Americans unfavourable to that country. He has also addressed the nation, promising to bring ‘law and order’ – which means sending in the army – to deal with the demonstrations sparked by the murder of George Floyd.

Cyclical stocks outperformed their defensive counterparts in the final two weeks of May. This reflects a mood of optimism in the market, which is encouraging investors to buy stocks that are more sensitive to the business cycle and therefore riskier. There are several reasons.

First of all, the ECB has publicly unveiled a range of stimulus plans for economies. Investors can now see that borrowing is not being considered as a viable ‘way out’ from the crisis.

Additionally, Europe is easing its lockdowns. Although some countries are keeping the screws tightened in various ways, the news has given cause for widespread celebration, including among investors. The prospect of life resuming its ‘normal’ course also means that economies are starting to pick up again. After two months in shackles, consumers are resurfacing. Soon inventories will be depleted, order books will fill up and more money will change hands – which has given a boost to banking stocks.

Although it is a little early to tell whether the remedial rally by cyclical stocks will last, this change in trend illustrates the hopes placed by the market in consumers (and Main Street in general).

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.