Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.89 | 1.08 | 10'591.06 | 3'481.44 | 13'432.87 | 5'399.21 | 6'407.46 | 3'714.24 | 13'070.69 | 27'663.39 | 1'329.57 |

| Trend | |||||||||||

| %YTD | 0.67% | -0.02% | -1.05% | -2.00% | -2.08% | -2.74% | -0.82% | -1.11% | 1.42% | 0.80% | 2.97% |

The main equity indices receded last week amid a sharp uptick in volatility. The virus is still making worrying headlines as Covid-19 infections worldwide climb above 100 million. News about vaccines spooked investors, concerned by the production delays, which is making the rollout far slower and compounding existing difficulties relating to storage and administration. One trouble spot was the tug of war between AstraZeneca and the EU. Ultimately, the longer it takes to dispense the vaccines, the longer it will take to restore economic fortunes. In other news, GameStop – a small deeply indebted US video-games producer that had been heavily shorted by hedge funds betting on a bankruptcy – triggered a furore in the market.

On the economic front, US GDP rose by 4% in the fourth quarter. Meanwhile the IMF upped its economic growth forecast for 2021 to 5.5% (up 30bp relative to the October estimate), factoring in the massive government support and the historically low interest rates.

It looks likely that the US will receive a USD 1.9 trillion fiscal jab. This package is set to be approved in Congress this week, with or without Republican support.

GameStop’s share price soared by 1,600% in January to give the company a market capitalisation of USD 23 billion. Thanks to internet platforms, information has become available to everyone, and anyone can express and share their opinion. At the same time, stock trades have become cheaper and faster to execute. An organised band of amateur investors has been able to group together, notably through Reddit’s WallStreetBets page (which now has 5 million followers), against the experts to buy securities or call options on companies such as AMC Entertainment or Bed Bath & Beyond. Prices have thus soared to the detriment of some hedge funds, sitting on large short positions in these same securities and consequently forced to offset their losses through short covering.

These ‘Goliaths’ reportedly suffered combined losses of exceeding USD 40 billion in January. There was also collateral damage, with profit-taking on other securities that had been doing well. More than simply a question of sums, the core issue is the possible instability of the financial system caused by the arrival of new market forces that will undoubtedly have to be taken into account in the future.

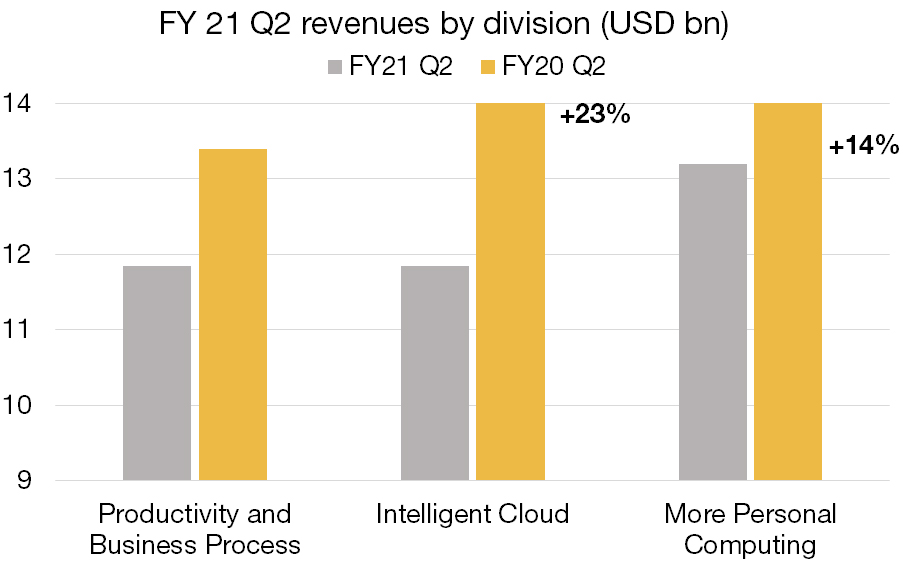

Microsoft released its best figures in its 45 years of existence when reporting second-quarter financials last week.

All divisions posted growth above expectations. Revenues soared to USD 43 billion, a 17% increase over the September-December 2020 quarter, and earnings clocked in at USD 17.9 billion (+29%), equating to USD 2.63 per share.

As the Covid-19 pandemic has been raging, Microsoft has seen increased demand for computers (Surface), its Office 365 suite and teleworking tools (Teams). Video games are also faring strongly.

The Azure remote computing division (cloud computing) has gained handsomely from accelerated migration to the cloud as companies large and small alike store their data and software online.

This division today generates almost as much as revenue as Windows, the company’s time-honoured cash cow. Use of Teams, a business communication platform, has likewise surged, while sales of the Office 365 suite jumped by 21%.

The pandemic has sped up digitalisation. But this is also a long-term trend, for which Microsoft is producing the right gear. For the next quarter, Microsoft is confidently aiming for revenues of USD 40.4-41.3 billion.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.