L’actualité économique et financière vous intéresse ?

La banque Bonhôte est heureuse de vous accueillir et de mettre à votre disposition ses experts en matière d’actualité financière.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 0.99 | 11'130.46 | 4'197.94 | 15'307.98 | 7'129.73 | 7'882.45 | 4'090.46 | 11'718.12 | 27'670.98 | 1'013.67 |

| Trend | |||||||||||

| YTD | -0.09% | -0.36% | 3.74% | 10.66% | 9.94% | 10.13% | 5.78% | 6.54% | 11.96% | 6.04% | 5.99% |

(values from the Friday preceding publication)

Over the past week, investors have been dancing to the tune of various speeches by US central bankers who have reiterated that the fight against inflation is not over and further rate hikes are in the pipeline. However, investors have priced in the onset of disinflation and do not believe that further rate hikes will be necessary. Instead, they have been more concerned about corporate financial results, which have been mixed so far.

Oil prices rose more than 2% on Friday after Moscow announced voluntary production cuts, further dampening hopes of a sharp fall in inflation.

Against this backdrop, bond yields have risen sharply to levels not seen since the beginning of the year. The US 10-year yield has climbed to 3.74% and the German equivalent is at 2.37%.

Initial jobless claims rose for the first time in 6 weeks to 196,000 in the week starting 30 January, up from 183,000 in the previous week, underlining the resilience of the US labour market. Despite a growing number of layoffs, now extending beyond tech firms, many companies – especially smaller ones – are still finding it difficult to hire staff, which is allowing the labour market to remain firm amid aggressive Fed tightening.

In contrast, the Michigan Confidence Index reassured markets with a better-than-expected initial estimate for February of 66.4 versus the expected 65. Consumers, however, are in a state of flux, unsettled by inflation and employment trends.

In Europe, German industrial orders rose more than expected in December, up 3.2% on a seasonally adjusted basis against expectations for a 2.0% rise.

German consumer prices rose less than expected on a 12-month basis in January. The European HICP increased by 0.5% compared to December and by 9.2% year-on-year, against expectations of 10.0%.

In contrast to Germany, Swiss inflation was 3.3% year-on-year in January, 0.6% higher than in December and compared with a forecast of 3.1%. Energy and food prices, especially bread and coffee, were to blame.

This week we are awaiting US inflation figures, which could underpin the more hawkish tone of the various Fed members regarding the continuation of monetary tightening. We believe that these figures will determine the direction of the markets this week.

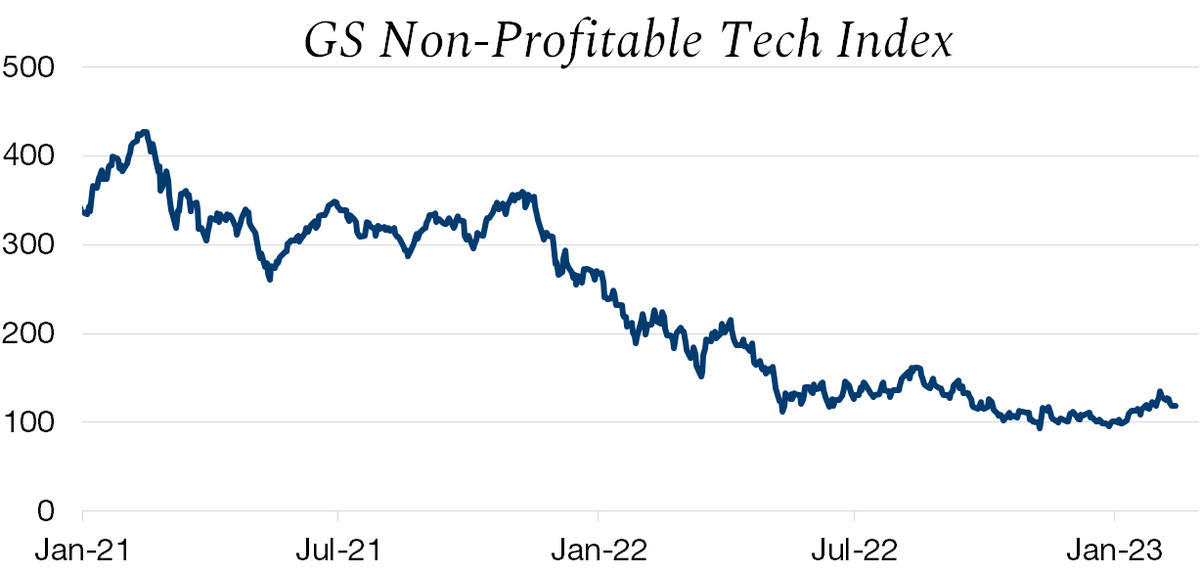

The past decade was characterised by highly expansionary monetary policy, with policy rates kept close to zero or even in negative territory. A renewed appetite for risk came to the fore as risk-free assets were no longer money-making. As interest rates return to more orthodox levels, funds invested in high-risk sectors or investment vehicles are likely to be partially reallocated to more stable investment solutions. During this period, asset prices in entire sectors have risen sharply for no fundamental reason. This analysis is supported by the Goldman Sachs basket of non-profitable US technology companies (see chart).

To navigate this new environment, in 2022 Bonhôte launched an investment vehicle called Megatrend, the essence of which is to take advantage of opportunities and biases in markets.

Megatrend is a global equity fund with a quantitative investment process that essentially follows three paths. Firstly, the fund invests in a diversified manner across eight themes, targeting the big themes of tomorrow that are considered to have the highest upside potential. Second, it exploits a market bias known as the quality factor by selecting only securities with impeccable and well-established financial strength. Thirdly, the portfolio harnesses the ESG bias by optimising the final stock selection from a sustainability perspective.

The above process ensures that the fund invests only in the strongest and most profitable companies that are active in forward-looking themes and have the best sustainability characteristics. The resulting stock selection aims to capitalise on favourable tailwinds and avoid the high waves that can arise when seas become choppy.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.