L’actualité économique et financière vous intéresse ?

La banque Bonhôte est heureuse de vous accueillir et de mettre à votre disposition ses experts en matière d’actualité financière.

Video produced in collaboration with Le Temps

One would assume that the Swiss National Bank’s decision to raise interest rates would act as a damper on property prices by increasing the cost of financing. Instead, between the summers of 2022 and 2023, the prices of apartments sold under commonhold arrangements increased by 3.4%, while single-family house prices rose by 1.2%.

Two primary factors contribute to this market paradox. Firstly, the residential sector maintains an exceptionally low vacancy rate. For instance, in June, it stood at 0.98% in the canton of Vaud and was as low as 0.45% in the city of Bern. Secondly, there has been a real shortage of new constructions, especially in highly sought-after areas. In recent months, Switzerland has issued just 10,000 building permits, with nearly 6,000 allocated to single-family houses. The limited supply of properties entering the market is fuelling demand and, consequently, supporting price levels. It is also worth noting that rising interest rates have led to higher rents, which have somewhat alleviated the downward pressure on property prices.

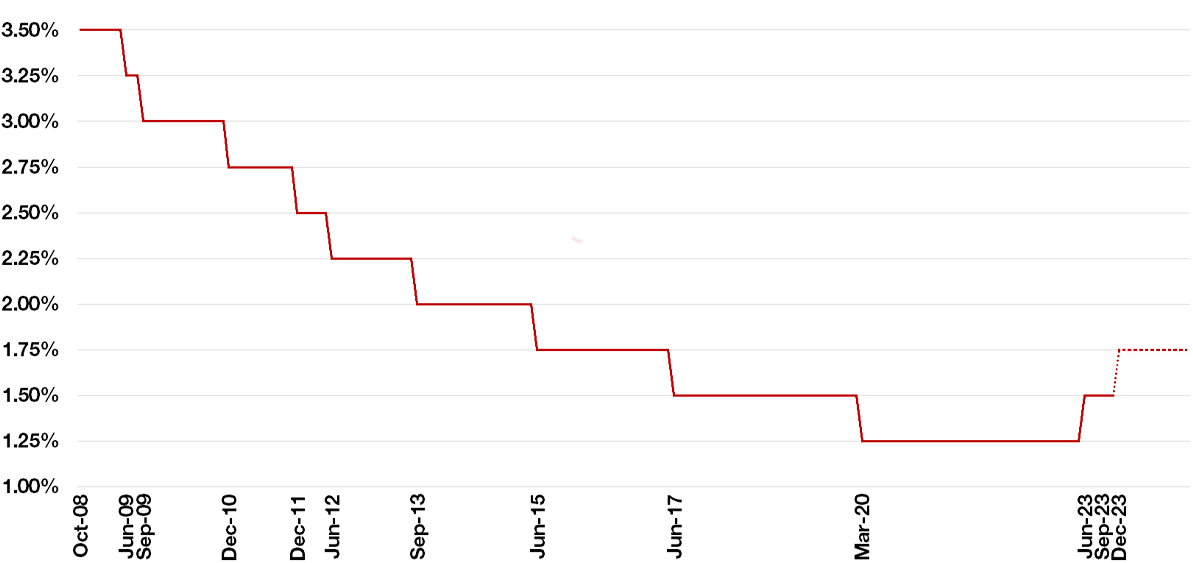

A deeper understanding of this phenomenon requires us to acknowledge that the uptick in interest rates has elevated the reference rate for leases. This rate’s calculation based on mortgages concluded in Switzerland, has been at 1.5% since 1 June, marking a 0.25% increase. Additionally, as rents are influenced by inflation, it is probable that rent hikes will persist.

While landlords do have the leeway to increase rents (by up to 40% of CPI), they must tread cautiously to avoid reaching levels that are indefensible or unsustainable for tenants. Rent rates for newly constructed homes are already high, meaning that landlords are reportedly having trouble filling them. Ultimately, supply and demand dynamics will dictate rent levels, and a shift may occur if property prices decrease or developers reduce their profit margins.

Curiously, from a financial perspective, renting has now become a more attractive option than owning property. Factoring in mortgage arrangement costs, property maintenance expenses, the cost of debt and the returns on the invested capital, it is cheaper to rent a 100 m2 flat than to own it outright. This marks a departure from previous years when historically low mortgage rates made ownership financially advantageous. This shift is likely to persist unless interest rates see a substantial decline.

Evaluating immediate ownership costs versus renting represents only a part of the equation. Over the long term, property ownership typically offers appreciation in asset values. In Switzerland, residential property values are estimated to double every 30 years. Investment properties, however, present a somewhat different picture. With many properties struggling to find buyers, prices are experiencing a modest decline.

In the investment property market, the focus is shifting from selling price to yield – the return expected by the owner through rental income. Sellers are still hoping to secure prices that buyers are unwilling to pay, especially amidst rising interest rates. No one wants to pay 3% interest for a gross yield of only 3%, which means an even lower net return after expenses and taxes.

Transaction volumes in Switzerland have plummeted by an estimated 20-25% compared to the two-year average. Consequently, supply currently outweighs demand. Nevertheless, prices are not experiencing a substantial freefall. This can be attributed to the fact that financial considerations are not the sole determinants in property acquisition. Emotional factors, such as the desire to own one’s own home, continue to sway the investment process.

As autumn sweeps in, brace yourself for the grand sailing show of the season: the Transat Jacques Vabre, an epic journey from Le Havre to Martinique.

Can Alan Roura beat the 2017 record of 13 days, 7 hours, 36 minutes and 46 seconds in an IMOCA 60? Join us as Bonhôte proudly supports this all-Swiss crew as they set sail on 29 October.

From 23 June to 29 October, the Fondation de l’Hermitage will transport you to the world of Edouard Vuillard (1868-1940), viewed through the lens of the Japanese art movement that captivated fin-de-siècle Paris.

Proudly serving as the main sponsor of the foundation’s summer exhibitions since 2018, Bonhôte was delighted to have invited its clients and friends to a private evening inaugurating this extraordinary exhibition.

Bienne was recently enchanted by the allure of French cinema for its 19th Helvetia French-Language Film Festival.

As the main sponsor for the 14th consecutive year, we hosted a gala screening of Le Théorème de Marguerite with its director, Anna Novion, one memorable evening for our esteemed guests. The screening was followed by a discussion with Jean-Pierre Darroussin, who stars in the film, and a delightful surprise: a visit from Jean-Pierre Améris, the director of Marie-Line et son juge.