L’actualité économique et financière vous intéresse ?

La banque Bonhôte est heureuse de vous accueillir et de mettre à votre disposition ses experts en matière d’actualité financière.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.90 | 1.07 | 10'322.57 | 3'204.05 | 12'480.02 | 4'960.88 | 5'935.98 | 3'509.44 | 11'895.23 | 24'325.23 | 1'176.36 |

| Trend | |||||||||||

| %YTD | -6.94% | -1.56% | -2.77% | -14.45% | -5.80% | -17.02% | -21.30% | 8.63% | 32.57% | 2.83% | 5.54% |

Equity markets staged a V-shaped rally last week in the wake of their sharp correction in late October, encouraged as the US presidential election went smoothly ahead on 3 November. At the same time, many companies reported better-than-expected earnings, and economies continued turning the corner. On a global scale, equity markets recovered by 7% despite the worsening Covid-19 pandemic. Nasdaq even surged by 10%.

The official proclamation on 7 November that Joe Biden had won the election, after a lengthy counting of votes, has not halted the party atmosphere in equity markets, even if Donald Trump has not yet conceded and is threatening legal action left, right and centre. The split Congress is seen in a positive light. Indeed, the ‘blue wave’ – in which the Democrats would have taken control of Congress as well as winning the White House – did not happen. If the Senate retains a Republican majority (pending the result in Georgia), it will be difficult to force through major legislative changes. For the time being, this is welcomed by investors, who believe that any tax corporate increases will be blocked. As far as relations with China are concerned, the trade war is not necessarily going to end as it started even before Trump took office. But communication channels are likely to be more open, with rounds of talks centring on mutual benefits. Moreover, foreign investors had strongly increased positions in Chinese shares ahead of the election.

The US employment figures released on 6 November were cheered by investors. In October, the unemployment rate fell from 7.7% to 6.9% and private-sector job creation clocked in at 906,000. The figure for all sectors combined totalled 638,000 versus the consensus forecast of 600,000.

The UK economy looks set to contract even further in the fourth quarter amid new virus-related restrictions and the Brexit process. The Bank of England last week boosted its asset-purchasing facility by USD 150bn to USD 800bn between now and the end of March 2021 to bridge the gap in household and corporate funding. Meanwhile, the US Federal Reserve is due to maintain low rates as long as inflation does not exceed 2% and will continue purchasing Treasury bonds. Interest rates are set to remain low for a long time, which reinforces the ‘Tina’ effect (‘there is no alternative’), driving the valuations of risk assets and growth stocks ever higher.

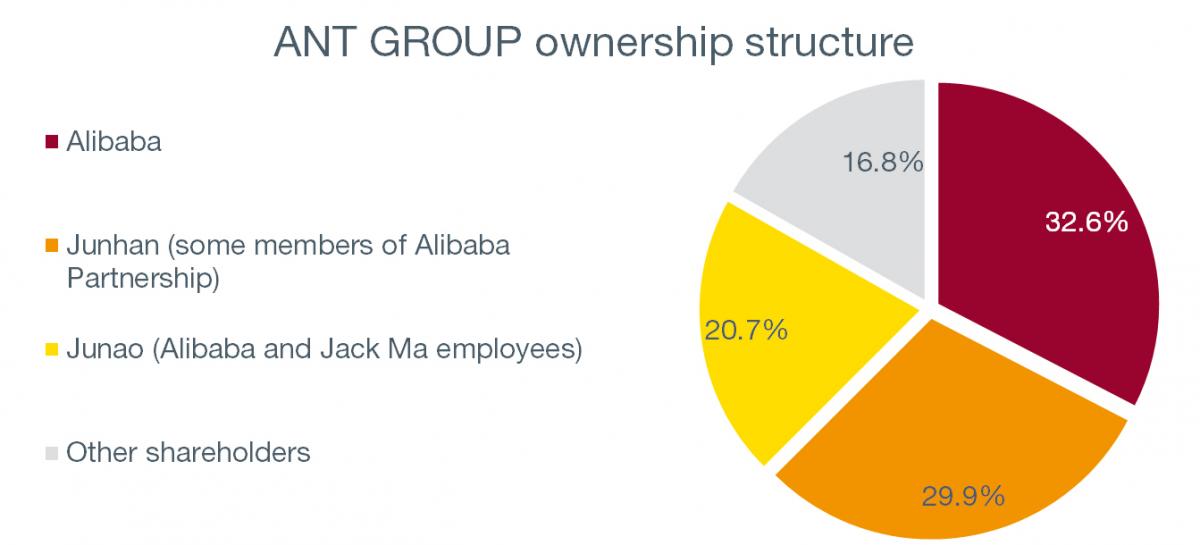

Alibaba’s share price plunged last Tuesday after the IPO of Ant Group, its financial arm (with subsidiary Alipay), was suspended and may not even take place at all now following the meeting between Jack Ma, founder and chairman of Alibaba Group, and Chinese regulatory authorities.

A change in the regulatory environment for fintechs – which operate at the leading edge of innovation, offering online payments, lending, wealth management and insurance services – is under way in China. They are accused of increasing systemic risk. However, the political aspect undoubtedly looms large, with a desire to limit the power of the sprawling Ant Group and Jack Ma by the same token. Speaking at a conference on 24 October, Ma compared China’s big banks to “pawnshops” that lend only to the rich and state-owned enterprises. According to him, there is be no financial risk in China because there is no financial system.

Ant Group’s valuation prior to the IPO, priced at HKD 80 per share, suggested a target of approximately USD 280bn. The company may now require additional capital to comply with stricter regulatory constraints. In particular, the collateral requirement for loans could become significantly higher, which would imply a reduction in the initial valuation from 4.4x to 2x book value, in line with the benchmark for major Chinese banks.

Alibaba reported a 30% year-on-year increase in revenues for its second quarter, lifted by a steady recovery in consumer spending. Earnings were far above expectations. The cloud computing division, which saw its revenue surge by 60%, could become profitable next year.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.