L’actualité économique et financière vous intéresse ?

La banque Bonhôte est heureuse de vous accueillir et de mettre à votre disposition ses experts en matière d’actualité financière.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.90 | 1.08 | 10'501.18 | 3'527.79 | 13'335.68 | 5'598.18 | 5'935.98 | 3'638.35 | 12'205.85 | 26'644.71 | 1'230.72 |

| Trend | |||||||||||

| %YTD | -6.48% | -0.31% | -1.09% | -5.80% | 0.65% | -6.35% | -21.30% | 12.62% | 36.03% | 12.63% | 10.41% |

Main stock indices are set to finish the month close to setting new records, boosted by hopes that Covid-19 vaccines will spell the end of the emergency health restrictions. This mood of optimism has remained intact even though the US and Europe have reacted to the high number of new infections by reinstating controls on businesses and travel.

The MSCI World Index is up 12% since the beginning of the month, driven by Europe’s remedial rally, with the equity indices of the worst-hit countries – Milan, Madrid and Paris – leading the way. Stocks in those sectors hurt most by social distancing measures have recovered sharply, such as cyclicals (airlines, cruise operators and oil companies). So have financials. The ECB has signalled that banks may pay out dividends again from next year onwards, while lenders will have to convince regulators that their balance sheets are sturdy enough to survive the pandemic. Retailers have also staged a strong comeback as their stores have reopened. The share prices of H&M and Inditex have shot up by more than 30% at the expense of online retailers such as Zalando. The best-performing companies in the sector are likely to see major revisions in earnings growth estimates.

The risk-on mood was also helped last week as the obstacles for Joe Biden to take up residence in the White House were one by one removed. Donald Trump no longer opposes the transfer of power, opening the way for a smoother transition. This also reduces uncertainty over global trade and foreign policy and galvanises enthusiasm for implementation of a fiscal stimulus package. Moreover, the appointment of former Fed chief Janet Yellen as Treasury Secretary is widely seen as ‘Christmas come early’, suggesting tighter coordination of monetary and fiscal policy in the future.

Macroeconomic signals have also been encouraging. The pick-up in China’s manufacturing sector in November, with the PMI index clocking in at 52.1, is the best such result since 2017. The Chinese economy stands to be the first major power to recover from the damage wrought by the coronavirus.

Oil prices are under pressure ahead of the meeting between OPEC and its allies to decide whether or not to extend production cuts into 2021.

The Swiss equity market has its own particular structure. As we all know, three heavyweights overwhelmingly dominate Swiss indices. Nestlé (19.7%), Roche (14.2%) and Novartis (13.4%) alone account for 47% of the SPI benchmark, or even 50.8% of the SMI index of the 20 largest capitalisations in the Swiss market.

This concentrated structure of so-called defensive securities, to which one could today add Swisscom and perhaps even Alcon, forms a grouping perceived by investors as a ‘safe haven’ block that can function as a proxy to bonds when interest rates are negative. This can be seen in times of stress, when investors are seeking to pull back on risk.

As with investment-grade bonds, these securities plays a safe haven role, relegating the notion of fundamental value to a secondary role.

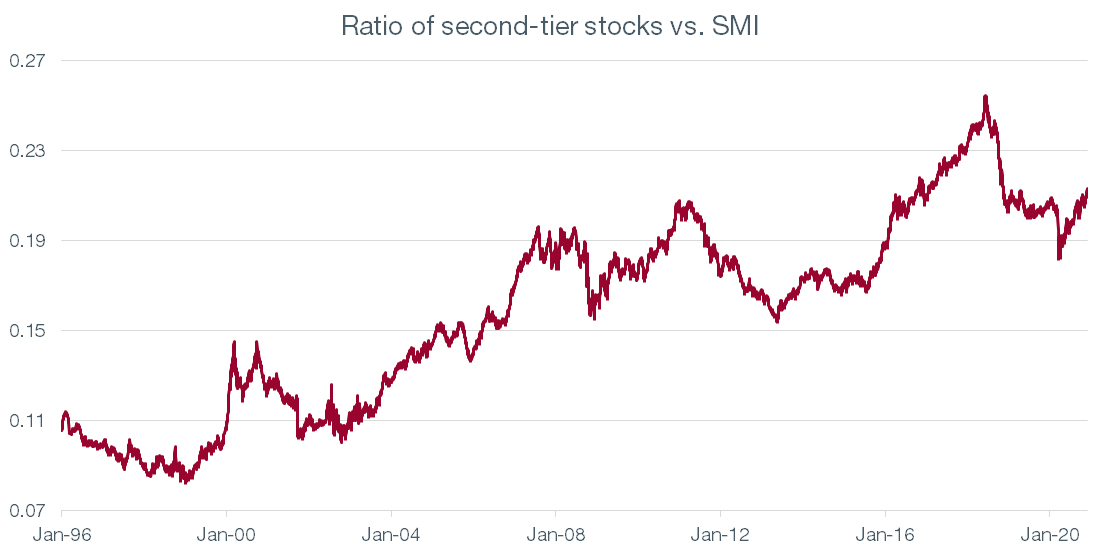

In absolute terms, fundamentals are not excessively priced – based on current multiples – for the two Swiss pharma flagships. However, in the market phase that is before us, with a vaccine due soon and the days of the lockdown measures probably numbered, second-tier stocks seem to be best placed because they are trading from further behind.

The ratio between secondary stocks and the large cap index has inverted since late April, and second-tier stocks have outperformed blue chips by more than 12% since that date. This trend is set to continue and could even gather pace in the coming months.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.