Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.99 | 0.99 | 10'787.77 | 3'688.33 | 13'459.85 | 6'416.44 | 7'334.84 | 3'770.55 | 10'475.25 | 27'199.74 | 884.98 |

| Trend | |||||||||||

| YTD | 9.00% | -4.55% | -16.22% | -14.19% | -15.27% | -10.30% | -0.67% | -20.89% | -33.04% | -5.53% | -28.17% |

(values from the Friday preceding publication)

Markets bounced back last week, buoyed by hopes of eased pandemic-related restrictions in China and by news of slightly higher US unemployment in October.

On the monetary front, the Fed as expected raised rates by three quarters of a percentage point, lifting the Fed Funds range to 3.75-4%. However, it was also stated that future decisions would consider the impact of tightening on economic and financial developments more fully, which might mean a slower pace of rate increases. Responding to the news, yields rose on bonds, with US 10-year paper hitting a high around 4.20%.

In manufacturing, both the Chicago PMI for October and the Dallas Fed Manufacturing Index showed sharper-than-expected slowdowns. From a broad perspective, the ISM Manufacturing Index for October weakened to 50.2, down from 50.9 the previous month.

Job openings in September were up by 4%, reflecting the resilience of the labour market. In October, job creation in the non-farm sector reached 261,000, which was higher than expected. Additionally, initial jobless claims clocked in at 217,000, a whisker below the forecast 220,000. In contrast, the unemployment rate rose to 3.7%, from 3.5% in September. The hourly wage increased in line with expectations, rising by 4.7% year-on-year. Taken together, these factors point to a slowdown in economic activity and therefore inflation, adding weight to the hypothesis of the Fed’s desired soft landing.

However, despite ticking up at the end of the week, the S&P 500 ended the week down 3.35% while the tech-heavy Nasdaq, more sensitive to interest rate expectations, shed 5.65%.

In the Eurozone, 12-month inflation rose to 10.7% versus an estimated 10.3%. GDP growth in the third quarter was 2.1%, as expected. Making matters worse, the decline in manufacturing activity turned out to be even sharper than initially estimated in October, confirming that the sector has entered a recession.

In China, manufacturing activity in October contracted for the third consecutive month, but at a slower pace than in September. For example, the China Caixin Manufacturing PMI advanced to 49.2 last month. This was still in contraction territory but improved relative to the 48.1 reading in September.

Looming large this week are the US midterm elections, which could extend the volatile period that the markets are experiencing.

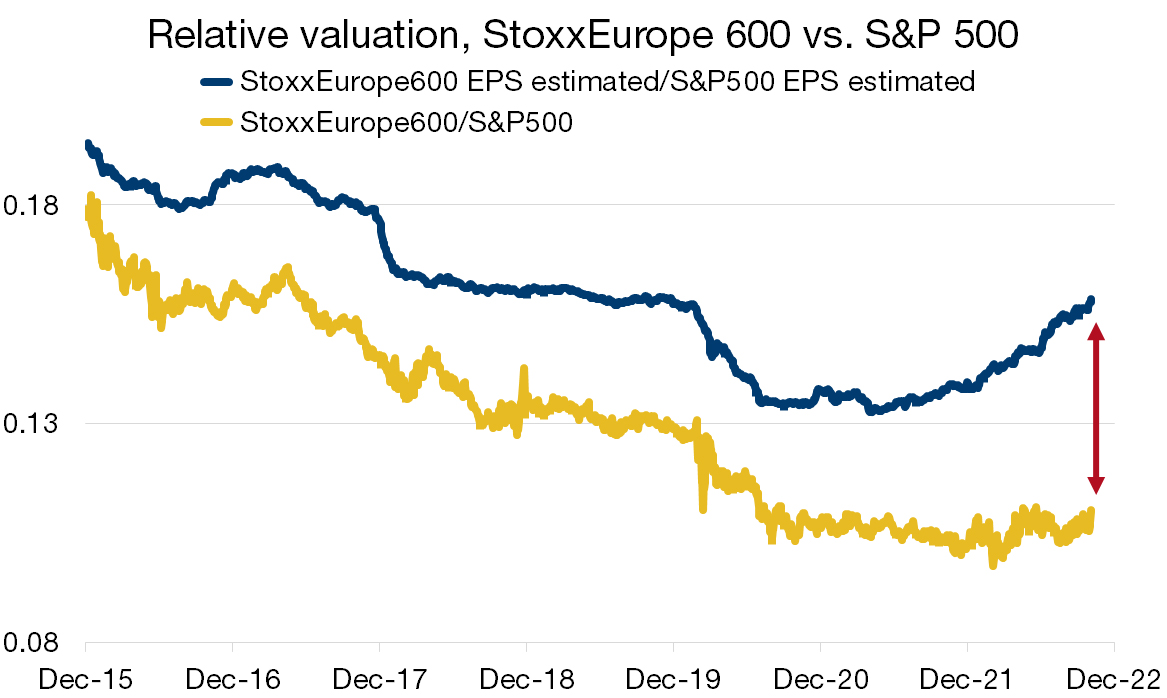

European companies have surprised the market positively in the current reporting season, much in contrast to their US counterparts. Earnings growth in Europe has been resilient, and this does not seem reflected in share price performances.

The energy crisis, fallout from the war in Ukraine and fears of an imminent recession are discouraging investors from buying European stocks. Consequently, even though earnings have been boosted by the softer euro, the boom in commodities and the rise in interest rates (which helps the financial stocks so prevalent in European indices), indices do not seem to want to rebound.

The Stoxx Europe 600 is trading at a discount of over 30% to the S&P 500. European equities are already discounting a double-digit contraction in earnings estimates, compared with only 5% priced in for US stocks. Moreover, richer valuations make US equities ultimately more vulnerable to upsets. The gap between valuations based on actual and forecast earnings clearly demonstrates this discrepancy (see chart).

The multiples on which European stocks are trading, plus their surprising resilience in this reporting season, could argue in their favour.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.