Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.91 | 1.08 | 10'492.61 | 3'432.07 | 13'076.72 | 5'380.16 | 5'935.98 | 3'585.15 | 11'829.29 | 25'385.87 | 1'188.35 |

| Trend | |||||||||||

| %YTD | -5.58% | -0.46% | -1.17% | -8.36% | -1.30% | -10.00% | -21.30% | 10.97% | 31.84% | 7.31% | 6.61% |

The positive news announced by US pharmaceutical giant Pfizer, in collaboration with Germany’s BioNtech, last week gave a glimmer of hope and served as a catalyst for appreciation in stock markets. The preliminary trials of the vaccine, involving a cohort of 43,500 volunteers, demonstrated 90% protective efficacy against Covid-19. Some 50 million doses could be available by the end of the year. Several other vaccines are also in phrase-three trials, for example at Johnson & Johnson and Astra Zeneca, which is also encouraging. Over the past week, vaccine news has triggered a sharp bounce in tourism-related sectors, financial stocks and cyclicals. There is hope – even if, in the short term, new infection cases may dampen economic growth, with France and Italy particularly badly affected and the US seeing a peak in hospitalisations, which have shot up by 40% over the past two weeks.

The aftermath of the US election, now clearly won by Joe Biden, raises the prospect of a divided government and thus a continuation of business-friendly policies. So things could hardly be better for equities. In Congress, the Republicans will probably retain their Senate majority, even if everything is not yet decided in Georgia, with two positions outstanding. The upshot is therefore a clearer outlook on the political front. In addition, important announcements on monetary measures are also expected from the Federal Reserve.

Optimism prevails among investors as we kick off a new week. Although the coronavirus is still raging in many parts of the world, business and commerce have remained relatively free of shackles, with local services such as restaurants, bars, sports halls and some shops shut down but companies continuing more or less as before.

The historic trade agreement between 15 Asia-Pacific countries, including China, Japan, South Korea and Australia, has pleased investors. This area represents about 30% of the world economy and 2.2 billion consumers. Officially called the Regional Comprehensive Economic Partnership, this deal will add an estimated 0.2% GDP growth to members’ economies and, by extension, boost the world economy. In addition, the robust economic recovery in China and Japan is strengthening confidence. Japan exited its recession in the third quarter, reporting GDP growth of 5% relative to the prior quarter compared with the 4.4% expected. Though the economy is still performing well below pre-Covid levels, the news is still encouraging. Chinese manufacturing output expanded by 6.9% year-on-year in October and retail sales by 4.3%. Business investment rose by 1.8% over the first ten months of 2020.

The latest statistics indicate that Chinese economic activity is back on track. Whether in terms of domestic growth or exports, China seems to have completely got over the pandemic.

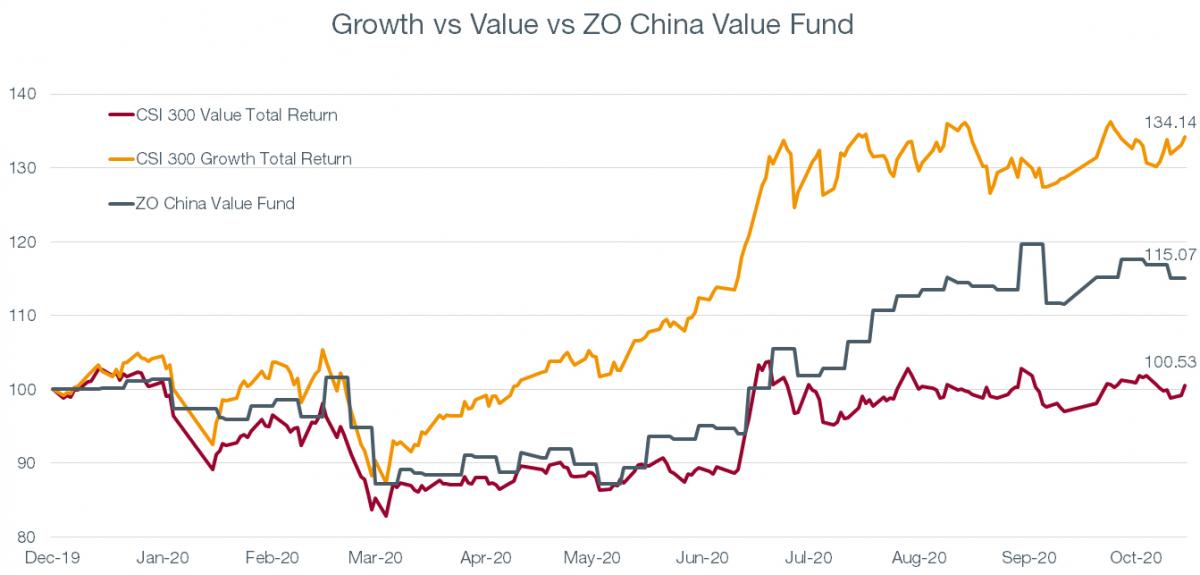

To date, it is mainly growth stocks that have fuelled market growth. However, with the economy returning to normal, signs of a readjustment between ‘growth’ and ‘value’ styles, favouring the latter, are becoming more visible. Here’s why:

China’s GDP grew by 4.9% year-on-year at the end of the third quarter, thanks in particular to a strong recovery in value-oriented sectors such as manufacturing and automotive. These industries are benefiting from both strong domestic demand and improved production capacity.

Given the modest economic improvement in recent months, Chinese households – especially the swelling middle class – are again directing spending towards sectors in the domestic economy such as education, leisure and food.

The Chinese government is implementing several measures to give consumer spending and investment a more domestic tilt. And it is working to advance the value chain in sectors such as healthcare, education and insurance.

These long-run shifts towards a more domestic-centric economy are set to benefit value-oriented portfolios such as the Convergence ZO China Value Fund.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.