Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.04 | 12'607.73 | 4'199.16 | 15'623.31 | 6'991.68 | 7'291.78 | 4'712.02 | 15'630.60 | 28'437.77 | 1'238.54 |

| Trend | |||||||||||

| YTD | 4.02% | -3.63% | 17.79% | 18.20% | 13.88% | 25.94% | 12.87% | 25.45% | 21.28% | 3.62% | -4.08% |

(values from the Friday preceding publication)

Financial markets are ebbing and flowing, driven successively by feelings of enthusiasm and pessimism amid all-time high valuations. Omicron may be spreading but fears over its actual reach were resized last week. Leading equity indices recovered significant ground (Euro Stoxx 600 +2.7%, SMI +3.7%) as investors regained their appetite for risk thanks to various factors such as data pointing to resilient economic growth and share buybacks. Chinese authorities are trying to avoid a hard landing for their economy and are therefore prioritising stability for businesses in 2022. Countercyclical measures have been announced, aiming to achieve increased fiscal and monetary flexibility, in contrast to recent efforts to shore up regulations and encourage reductions in debt burdens.

Central banks are set to feature prominently this coming week as they conduct their final meetings of 2021. Before they were moving in unison but their timetables for tightening have started to diverge, such is the high degree of uncertainty surrounding high inflation and the duration of disruptions to production chains.

According to the consensus, the Fed is due to speed up tapering of its asset purchases, which is generating turbulence on government bond yields. Volatility is above the average for the past two years. The tenacity of inflation (+6.8% in November year on year) has stoked doubts among investors just when fiscal stimulus is starting to decrease. The yield curve has flattened following sharp increases at the short end, while long-term yields have levelled off. Together with energy and motor vehicles, the cost of housing is fuelling inflation in the US. The problem is that housing is a cost item that does not subside quite as quickly as it rises. Forecasts suggest that inflation will slow in 2022 but remain upwards of the Fed’s 2%.

Economists believe that the ECB will this Thursday decide on the shape of its post-PEPP regime (which is due to terminate in March 2022). The fear is that a more vaccine-resistant variant will again force governments across Europe to shut consumers in at home. In Christine Lagarde’s view, the rise in prices in Europe is not linked to sustainable factors, and an increase in interest rates is not slated before 2023. The Bank of England might leave rates unchanged following disappointing macroeconomic data and worsening Covid cases.

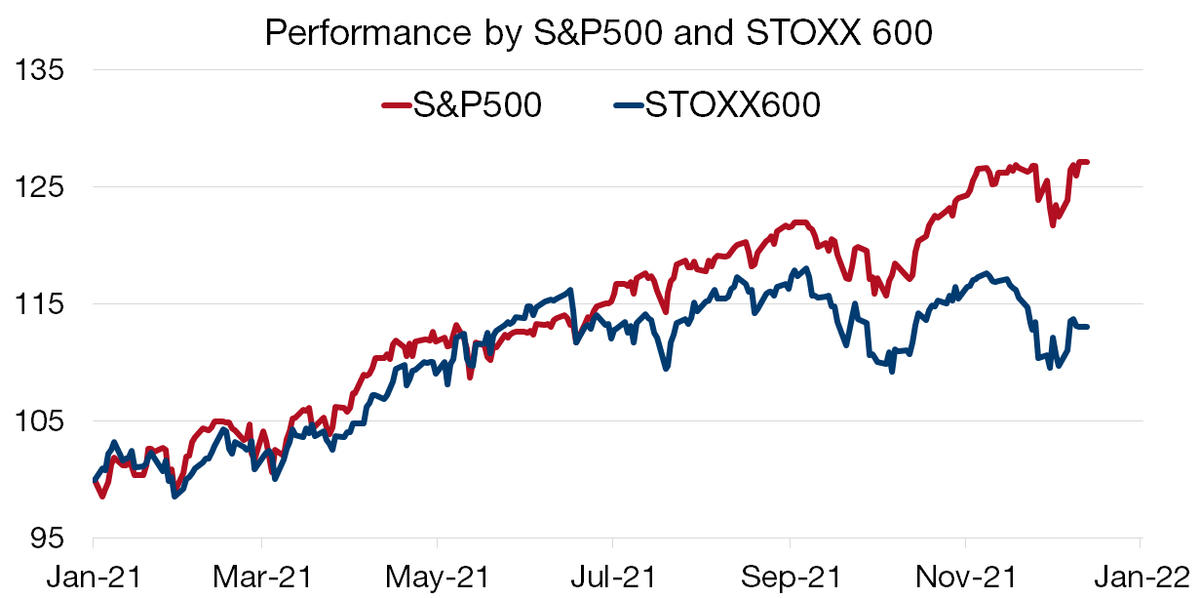

Over time, European equities tend to underperform their US counterparts. Now a weaker euro could give them the boost they need.

Eurozone companies generate more than half their revenue in the rest of the world, especially in the US. A soft euro is therefore a profit booster for large European exporters. A 10% fall in the euro adds about 2.5 percentage points to annual earnings growth. So far this year, the euro has fallen by 8% against the US dollar, and forecasts for the future are not optimistic.

Central bank policies are diverging. The Fed faces pressure from inflation and has spoken out about wanting to raise rates. Meanwhile the ECB is sitting on the fence and leaving its monetary support in place. This change should be favourable to the dollar and therefore put pressure on the EU currency. Companies with US exposure should therefore continue to fare better.

But while European equities look cheap, their yields are not attractive to US investors. The Stoxx 600 in dollar terms has only risen by 13% as measured on a total return basis, year to date. That is only half as much as the S&P 500 (+27%), although it should be noted that the composition of the two indices differs markedly, which partly explains the performance differential in recent years. Europe is loaded with financial and industrial stocks, while the US is tech and consumer heavy. The gap has been widened recently in tandem with the emergence of the Omicron variant, which has hurt European stocks, today trading at a 30% discount to US equities. All in all, despite the boost from a relatively weak currency, the European market, by virtue of its index make-up and the hazy outlook on other fronts, will probably continue to underperform the US.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.