Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging MArkets | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Latest | 0.98 | 1.11 | 9'762.98 | 3'497.63 | 12'323.32 | 5'572.86 | 7'505.97 | 3'013.77 | 8'244.15 | 21'685.90 | 1'050.90 |

| Trend | |||||||||||

| %YTD | 0.26% | -1.62% | 15.82% | 16.53% | 16.71% | 17.80% | 11.56% | 20.22% | 24.25% | 8.35% | 8.81% |

Last week’s testimony by Jerome Powell to the US Senate bolstered investors’ belief that short-term interest rates are indeed headed downwards. Powell’s remarks sent the S&P 500 index to a new all-time high despite the poor performance of leading pharma stocks. The sector is under pressure due to worries about forthcoming action plans instigated by the Trump administration and Congress aimed at reducing drug prices in the US, among the highest in the world.

Powell’s assertions that monetary policy has never been as accommodating as we think and that polls show business confidence declining, even with the economy at full employment, altered the line the Fed chairman had taken previously. This holds out the prospect that the US central bank is ready to cut its benchmark interest rate by 25 base points at its next meeting on 30 and 31 July or, as some observers think, that it even might take the unusual step of proceeding directly with a 50-bp downtick. Such largesse, if it comes, could appear overdone, since the Fed has already accomplished its mission of encouraging full employment and stable prices. The New York stock market indicators moreover stand at a record level, though uncertainty over trade and global economic growth could justify preventive rate cuts.

Meanwhile the minutes of the last policy meeting of the European Central Bank revealed that most of the governors believe new monetary stimulus is necessary. The ECB nudged its growth forecasts for the euro zone down to 1.2% for 2019 and to 1.4% for 2020. On the main bond markets, sovereign yields on long-dated issues rose 7 to 15 basis points following higher-than-expected inflation data. In the US, consumer prices ex food and energy were up 2.1% year on year and inflation in Germany was revised upwards to 1.5%.

On the macroeconomic front, China registered second-quarter growth of 6.2% year on year, the lowest level in 27 years despite the government’s efforts to stabilise business activity. Investors were nevertheless soon reassured by industrial production, which accelerated to 6.3% yoy in June, and by retail sales. Output by China’s heavy industry to some extent compensated weakness in manufacturing, which is geared towards exports. Moreover, the People’s Bank has plenty of leeway to gin up the economy.

EMS, specialised in the production of high-performance polymers, has reported its first-half 2019 results. Sales slumped more than 3.5% owing to the slowdown in Europe and China, mainly in the auto sector where demand is flagging against the backdrop of uncertainty arising from the trade war between the US and China.

The polymer plastics produced by EMS are lighter than steel and thus used frequently in automobile components. The resulting weight reduction enables vehicle manufacturers to enhance petrol mileage significantly.

The downturn in the group’s revenues came mainly in the second quarter, when sales declined 5.5%. Yet profitability was higher. Margins grew 1.6% to 29.9%, just shy of the 30% mark, largely thanks to shrewd cost controls.

EMS was also able to develop new business relations, most notably with the Italian coffee-machine maker Bialetti, for which the Swiss group will produce certain hard plastic components such as handles.

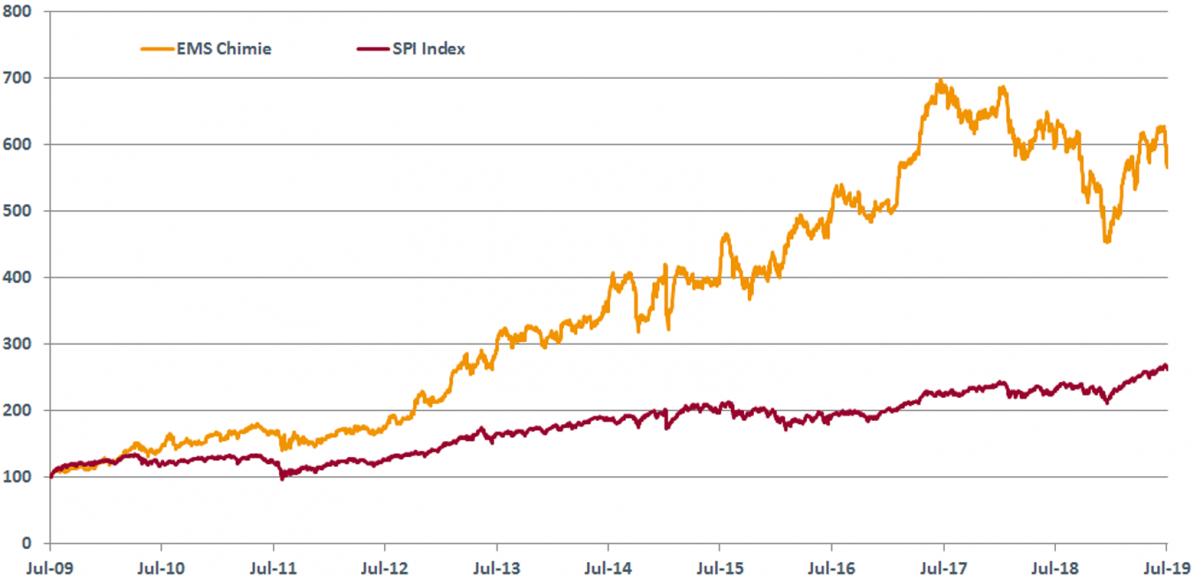

EMS Chemie’s share price has been buffeted since the beginning of the month. Considering it a growth stock, investors have legitimately high expectations but its valuation is just as lofty at 27 times current-year earnings.

The stock is one of the Swiss stock market’s most spectacular performers, having catapulted more than 780% in 10 years for an annual rise of 24%. The broad Swiss market has delivered a 161% progression over the same period.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.