Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.94 | 0.97 | 11'128.24 | 3'776.81 | 13'795.85 | 6'553.86 | 7'500.89 | 4'280.15 | 13'047.19 | 28'546.98 | 1'016.83 |

| Trend | |||||||||||

| YTD | 3.19% | -6.90% | -13.57% | -12.13% | -13.15% | -8.38% | 1.58% | -10.20% | -16.60% | -0.85% | -17.47% |

(values from the Friday preceding publication)

Last week featured the release of US inflation figures, which triggered a bounce in financial markets – much to the relief of investors.

Wednesday’s inflation print for July represented the first positive statistic on overall price trends since the Fed began tightening monetary policy, clocking in at 8.5% on a 12-month basis compared with 9.1% in the previous month. Core inflation (excluding food and energy) increased by 5.9% year on year whereas a 6.1% increase had been expected. The producer price index also stood still month on month, ebbing by 0.5% in July versus June, resulting in producer price inflation of 9.8% year on year compared with 11.3% in June.

These statistics have raised hopes that inflation may have peaked and the Fed will be less hawkish at its next meeting in September. The consensus is currently gunning for a 0.5% rate hike. A week ago, it was expecting 0.75%. Even so, inflation remains red hot – as various policy committee members have pointed out – and lies a far ways from their 2% target. The president of the Minneapolis Fed reiterated that it is unrealistic to expect a rate cut next year. Fed fund futures currently price in policy rates at 3.25-3.50% at end-2022 and 3.75-4.00% at end-2023.

A closer look at the CPI reveals that July’s standstill was mainly due to the fall in petrol prices (-20%). Food prices and rents are showing no sign of declining. As a result, core inflation is expected to remain well above the 2% target, adding legitimacy to the Fed’s monetary tightening moves at upcoming meetings.

The market reaction was unequivocal, with 90% of S&P 500 and Nasdaq 100 constituents closing higher on Wednesday. Consequently, this week marks the return of the risk-on trade after the tech sector saw a major influx of capital last week. The Nasdaq has even shaken off its bear market, having recovered by more than 20% from its June low. The S&P 500 is approaching its 200-day moving average (4330).

Indicators released in Europe last Friday still portray a gloomy economic picture, crystallised by mounting fears that the Eurozone will be pushed into recession by the gas supply crisis, which has piled more pressure on the euro. The market continues to foresee a 0.50% rate hike by the ECB next month.

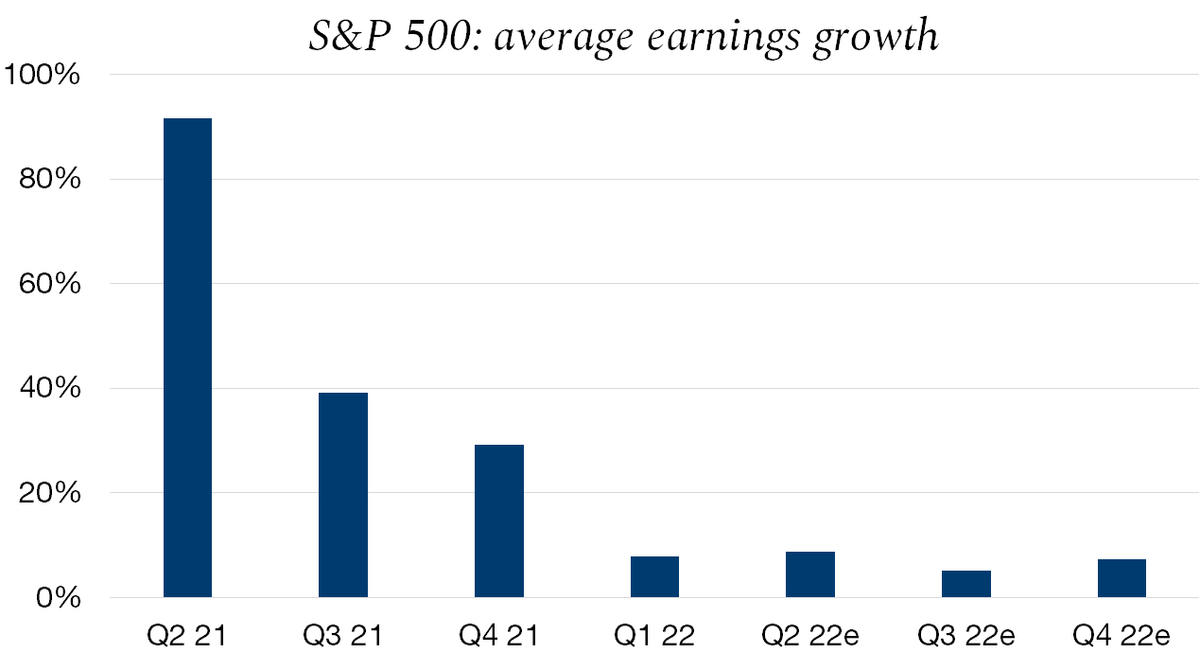

The second reporting season of 2022 is drawing to a close. Interestingly, investors have not punished stocks that fell short of expectations.

For this second quarter, companies that underperformed analysts’ estimates were rewarded on average with the highest price increase in five years.

S&P 500 companies that dashed earnings expectations gained around 0.6% after the release of their figures – in stark contrast to the 1.2% decline during previous earnings seasons on average.

This shows that the market had already incorporated the negative sentiment before the start of the earnings season.

Sectors performing worst in the second quarter were financials, with an average profit contraction of 21%, followed by tech and communication services (-5%). The big winner was unsurprisingly the energy sector, which saw its average earnings triple.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.