Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 1.00 | 0.98 | 10'418.60 | 3'476.63 | 12'730.90 | 6'035.39 | 6'969.73 | 3'752.75 | 10'859.72 | 26'890.58 | 865.04 |

| Trend | |||||||||||

| YTD | 9.39% | -5.11% | -19.08% | -19.12% | -19.86% | -15.62% | -5.62% | -21.26% | -30.59% | -6.60% | -29.79% |

(values from the Friday preceding publication)

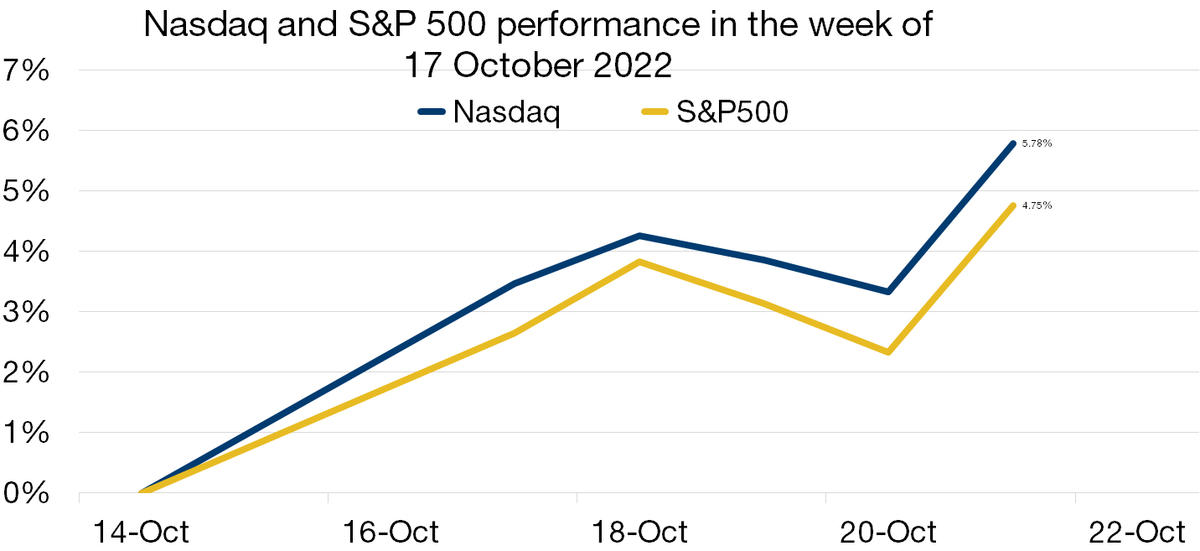

Equity market bounced back last week in spite of steadying rising bond yields. Corporate reporting season is in full swing and, on the whole, is playing out in line with expectations, with substantial price hikes aimed at countering higher input prices.

Over in bonds, the yield on US 10-year paper edged past 4.20%, driven higher by continued solid macroeconomic stats. The US 2/10-year spread last week narrowed by 30 basis points (bp) based on a 2-year rate of 4.50%.

Crude oil held steady (WTI at USD 84 and Brent at USD 92). European gas prices continued ebbing. The Dutch TTF spot price was EUR 130/MWh, down from a late-August peak not far from EUR 350/MWh.

In macroeconomic data, the latest US industrial production figures declined at a faster rate. The Empire State Manufacturing Survey for October showed a reading of -9.1 (general business conditions) after -1.5 in the previous month, relative to a forecast of -4.3. The ‘new orders’ component recovered slightly, improving to -15.9 versus -17.6 in September. In contrast, the six-month outlook worsened sharply to -14.9, compared with the previous reading of -3.9.

Initial jobless claims were better than expected, clocking in at 214,000 for the week ending 15 October. The expected figure was 233,000.

Cheered on, the S&P 500 ended the week with a sharp 4.74% gain. The more rate-sensitive Nasdaq was up 5.78%.

Consumer prices in the UK were up 10.1% year on year in September, propelled higher by food. This contrasts with +9.9% in August. The consensus estimate was +10%. The yield on 10-year Gilts eased from 4.5% to 3.0% after the resignation of prime minister Liz Truss, following the fiasco of her mini-budget aimed at rekindling economic growth.

Eurozone inflation in September came in below the initial estimate (+9.9% year on year versus +9.1% in August) but still remains dangerously high, suggesting that the ECB’s tightening cycle will continue.

In China, the XX Communist Party congress ratified Xi Jinping’s stranglehold on the apparatus of state but did not provide any further details on the pandemic strategy.

In earnings reports, this week will feature Apple, Microsoft and Amazon in the US. The ECB will also review its monetary policy.

The latest reporting season has provided some solace to investors. Two thirds of the companies that have reported earnings have beaten expectations. Though earnings guidance has been trimmed in places, the actual nine-month figures have been solid amid broad-based inflation and slowing business volumes. The tech sector was led even higher towards the end of last week by remarks from various Fed bosses suggesting that rate rises could be slower in 2023.

Three companies from the sector were the stand-out performers last week. First, Netflix took the market by storm with the turnaround in its subscriber numbers, clocking in at an extra 2.4 million versus the expected 1 million. The new ad-funded formula, announced recently, is also likely to drive revenue – much to the market’s liking. The share gained 26% over the week (-52% YTD).

In a different register, IBM was helped by its cloud division and, concurrent with its earnings report, increased growth guidance for the entire fiscal year. The share has been resilient year to date (-2.8%) and put on a further 8.21% over the week.

Tesla was somewhat disappointing, reporting lower-than-expected sales that were hurt by shipment issues and higher operating expenses arising from the new plants in Berlin and Austin reaching cruising speed. The share price plummeted by 6.65% on the day Tesla reported earnings, before pulling back and ending the week in positive territory at +4.61% (-39% ytd).

Tech stocks have corrected sharply this year, hit by higher interest rates, chip supply problems and slowing global growth in response to entrenched inflation. The sector is appealingly valued and sensitive to any change in the landscape. We expect a sharp recovery as soon as the pace of rate hikes slows and the global economy stabilises. This coming week will tell us more about the sector’s resilience as the mighty GAFA report their figures.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.