Strategy and investments

The fund’s objective is to build a stable and dynamically managed real estate portfolio.

Long term, Bonhôte-Immobilier SICAV aims to maintain the value of its investments and to distribute their income appropriately. As far as possible, therefore, it invests in properties that hold out above-average yield prospects.

Investors, regardless of their domicile in Switzerland, are exempt from income and wealth tax.

Investments

Bonhôte-Immobilier SICAV invests in :

- Swiss real estate, primarily in Western Switzerland

- Residential and mixed-use properties

- Commercial properties as well as selected industrial properties or workshops

- Housing projects.

Strategy

Geographic focus

Sector weightings

Average rent per canton in CHF/M2/an

Contact us

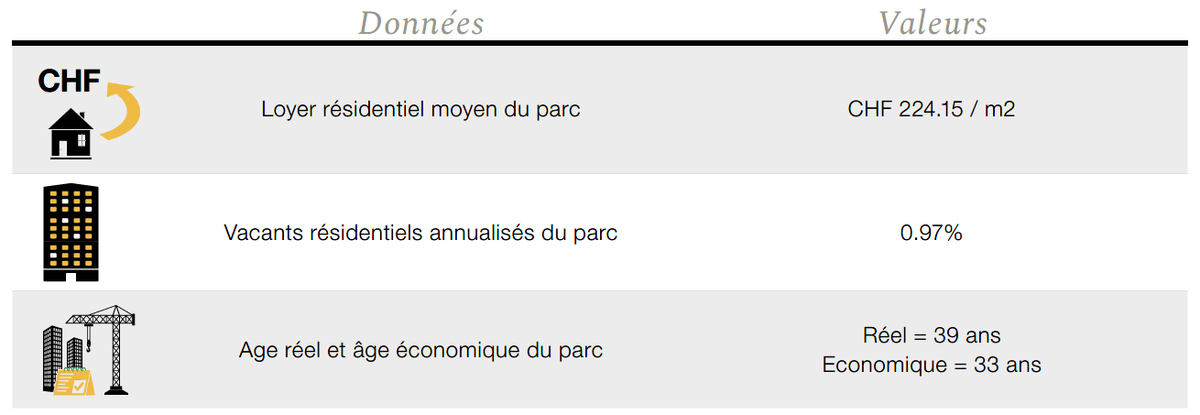

Property portfolio

Bonhôte-Immobilier SICAV, launched in October 2006, is an investment fund under Swiss law, as defined by the Federal Collective Investment Funds Act (LPCC) of 23 June 2006.