Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.89 | 0.98 | 11'342.86 | 4'390.75 | 15'807.50 | 7'519.61 | 7'871.91 | 4'137.64 | 12'123.47 | 28'493.47 | 1'000.49 |

| Trend | |||||||||||

| YTD | -3.34% | -0.72% | 5.72% | 15.74% | 13.53% | 16.16% | 5.64% | 7.77% | 15.83% | 9.19% | 4.61% |

(values from the Friday preceding publication)

Equity markets rallied further last week as macroeconomic data pointed to a slowdown in inflation, supported by better news on the health of US regional banks. Solid reports from luxury goods companies and the first set of US bank earnings also had a positive impact on risk appetite.

Bond yields rose slightly. The US 10-year yield hovered around 3.50% and the German equivalent was 2.40%.

In the US, inflation slowed to 5% in March, the lowest level since May 2021. But core inflation, which excludes food and energy, held steady at 5.6% from 5.5% the previous month, reflecting increases in housing and transportation costs.

US producer prices fell by 0.5% in March month-on-month, but rose by 0.1% excluding food, energy and trade services. On a 12-month basis, however, the rise in producer prices slowed to 2.7% on a headline basis and 3.6% excluding food, energy and trade services.

At the same time, retail sales fell by a larger-than-expected 1% in March, indicating that households are cutting back on purchases, particularly of cars and other big-ticket items.

All this points to a possible 25bp hike in the Fed funds rate at the next meeting in May, bringing the curtain down on the current tightening cycle.

In the Eurozone, CPI inflation in France was relatively stable in March compared with the previous month, at 6.7% versus 6.6%. In Germany, inflation was in line with expectations at 1.1% month-on-month and 7.8% year-on-year.

In addition, economic activity improved in February as industrial production rose by a better-than-expected 1.5% after a 1% increase in January.

In China, exports unexpectedly rebounded in March, partly reflecting pent-up demand in the form of unfilled orders from last year’s zero-covid policy. Exports rose 14.8% year-on-year last month, after falling 6.8% in January-February, compared with the consensus forecast for a 7.0% decline.

The S&P 500 ended the week up 0.79% while the tech-heavy Nasdaq rose by a more modest 0.29%. The Stoxx 600 Europe index gained 1.74% over the week.

This coming week will feature more earnings reports, plus the publication of the PMIs in the US.

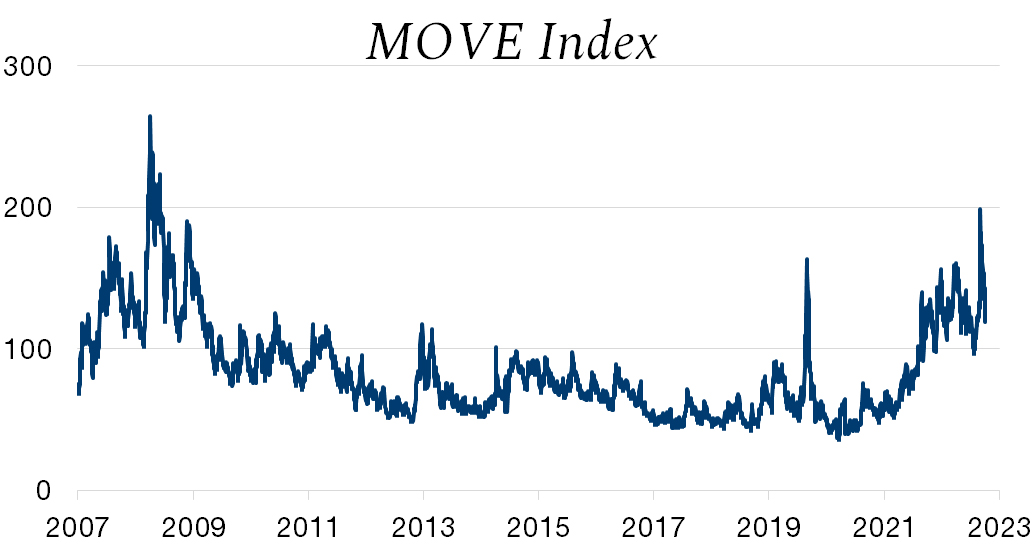

The MOVE index tracks volatility on US Treasury bonds. Specifically, it measures the probability of yield changes on Treasury bonds as implied by options pricing.

It is therefore a valuable tool for investors to assess bond market fluctuations and identify the right time to invest or exit based on implied volatility.

The MOVE index has reached historical extremes during some of the major events that have shaken financial markets in the past. In October 2008, for example, it reached 264 points in the wake of the global financial crisis. Investors fled risky assets and turned to US Treasuries as a safe haven, leading to strong demand for these bonds and a rise in their price. This brisk demand also led to an increase in their volatility, which contributed to the rise in the MOVE index. The same thing happened in March 2020, when the index peaked at 164 points due to the uncertainty surrounding the pandemic. More recently, the index approached 200 points as panic set in within the US banking sector.

In summary, the MOVE index tends to spike during periods of severe economic and financial turmoil and is therefore used by investors to gauge bond market stress.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.