Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.93 | 1.00 | 11'349.39 | 4'257.98 | 15'476.43 | 7'233.94 | 7'901.80 | 4'136.48 | 12'006.96 | 27'509.46 | 1'038.71 |

| Trend | |||||||||||

| YTD | 0.16% | 0.99% | 5.78% | 12.24% | 11.15% | 11.74% | 6.04% | 7.73% | 14.72% | 5.42% | 8.61% |

(values from the Friday preceding publication)

Equity markets continued to rally as rate hikes were announced in line with expectations and comments were made that the process would soon slow down. Rate-setters also highlighted the resilience of economic activity despite the restrictive effects of monetary policy.

Bond yields fell at the beginning of the week but ended the week flat. The US 10-year yield is around 3.5% and the German equivalent is close to 2.20%.

In the US, economic activity is slowing and inflation is easing. However, non-farm payrolls added 517,000 jobs in January, well above expectations. Looking at the private sector figures, job creation slowed to 106,000, below the 180,000 expected. Initial jobless claims fell to 183,000 in the week to 23 January from 186,000 the previous week. The unemployment rate fell 0.1 percentage point to 3.4% and average hourly earnings rose at an annual rate of 4.4%, slightly stronger than expected.

Durable goods orders (excluding transport) fell by 0.2% in December.

In Europe, economic doubts and energy shortages led to a sharp decline in German retail sales in December, which fell by 5.3% compared with a forecast increase of 0.2%.

The acceleration in consumer prices in France, from 6.7% in December to 7% in January according to harmonised European Union data, following the announcement of higher inflation in Spain, reinforced the ECB’s determination to continue raising interest rates at upcoming meetings.

The S&P 500 ended the week up 1.62%, while the tech-heavy Nasdaq rose 3.31%. The Stoxx 600 Europe Index gained 1.23%.

The corporate earnings season will continue this week and could lead to renewed volatility.

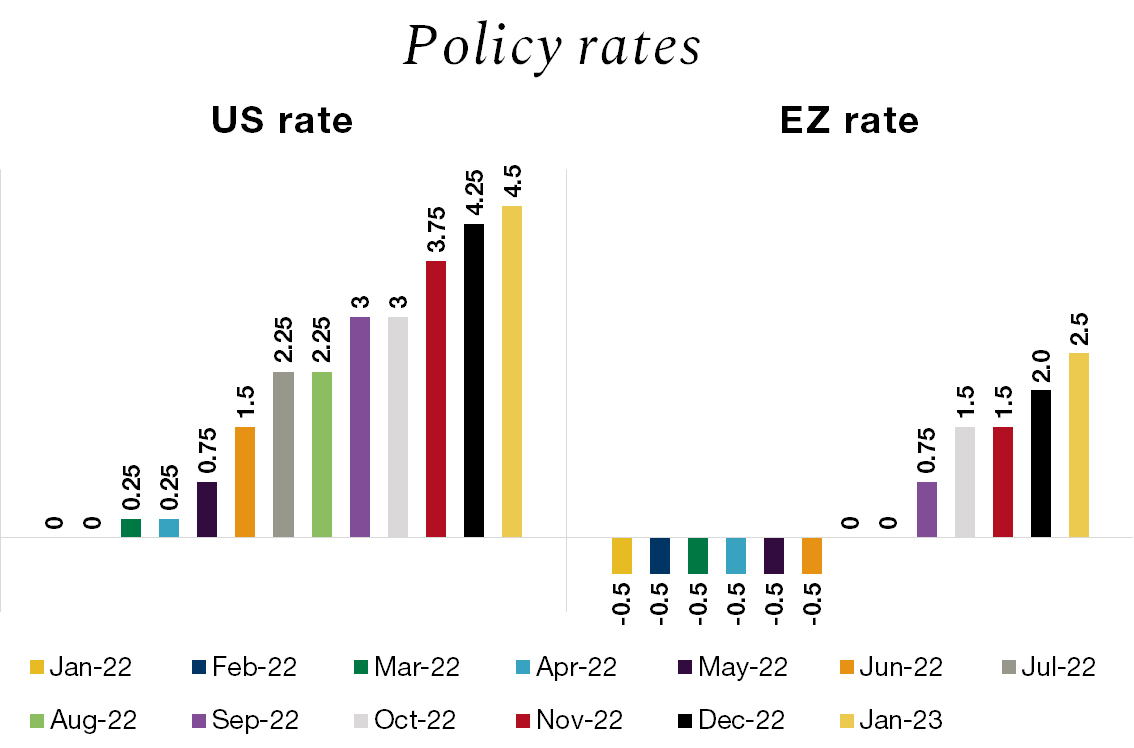

The disconnect between financial markets and messages stemming from central banks was illustrated on Wednesday and Thursday, following announcements by the US Federal Reserve (Fed) and the European Central Bank (ECB).

As expected, the Fed raised its benchmark Fed Funds rate by 25 basis points to 4.50-4.75%. Chair Powell acknowledged that the fight against inflation was paying off but stressed that recent progress was not enough for him to call time on rate hikes and a change of strategy was unthinkable at the moment.

Investors were reluctant to believe that a two-hike cycle was still on the cards and continued to bet on a cut before the end of the year.

The ECB also raised rates by 50 basis points on Thursday, as announced in December, and indicated that it expected to raise rates by the same magnitude in March. Lagarde pointed to the resilience of the European economy, which has held up better than expected. But despite a slowdown in inflation, there is still some way to go. In addition, the ECB will start reducing its balance sheet (EUR 9,000bn) by EUR 15bn per month from March. Reinvestments will focus on issuers with solid climate performances.

The markets immediately interpreted these decisions as a sign that the monetary tightening cycle was coming to an end and pushed the markets into the green, with yields easing significantly. Following these reactions, the International Monetary Fund stepped in to remind investors that interest rates will remain high for a long time, until inflation is brought below the central banks’ target in a sustainable manner.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.