Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.93 | 0.99 | 10'770.38 | 3'804.02 | 13'893.07 | 6'452.63 | 7'332.12 | 3'852.36 | 10'705.41 | 27'527.12 | 957.30 |

| Trend | |||||||||||

| YTD | 2.43% | -4.66% | -16.35% | -11.50% | -12.54% | -9.79% | -0.71% | -19.17% | -31.57% | -4.39% | -22.30% |

(values from the Friday preceding publication)

Equity markets last week consolidated as investors fretted about the effects of continuous monetary tightening amid the observed economic slowdown. As expected, the Fed lifted its rate benchmark by 50 basis points (bp) to a range of 4.25-4.50% and forecasts a total 75bp of tightening in 2023. US GDP projections were revised down to growth figures of 0.5% in 2023 and 1.6% on 2024. In the eyes of Chair Powell, any plans for rate cuts are for the time being premature.

Bond yields put in contrastive performances with the US 10-year yield stable at 3.50% while the yield on Germany’s Bund edged up to 2.15%.

In the US, economic activity continued contracting. Growth in consumer price inflation (CPI) slowed to 7.1% in November, falling short of the projected 7.3%. Excluding food and energy, inflation clocked in slightly below expectations at 6% in response to less brisk demand trends. In November, retail sales were down 0.6%, which was more than expected, while they had increased by 1.3% in October.

Meanwhile, industrial production edged down by 0.2%, following on from a 0.1% dip. The composite PMI for December staged a sharper drop than expected, registering at 44.6 versus the estimated 46.9.

On the jobs front, initial jobless claims slowed to 211,000 compared with 231,000 in the previous week.

In these conditions, the S&P 500 ended the week 2.08% in the red. Tech-heavy Nasdaq, which is more exposed to rate expectations, was off by 2.72%.

In Europe, the ECB also unveiled a half-point increase in policy rates, which were lifted to 2% (deposit facility) and 2.5% (benchmark refi rate). The economy is slowing up more sharply as testified to by the 2% month-on-month drop in Eurozone industrial production in October, following an increase of 0.8% in September.

Twelve-month inflation slowed in Germany during November to stand at 10% versus 10.4% in October. The Ifo economic research institute expects Germany’s GDP to contract by 0.1% in 2023 versus a 0.3% dip previously.

Over in China, industrial production advanced by 2.2% year-on-year in November, contrasting with 5% in the previous month, owing to continued pandemic-related restrictions, which hampered business output and dampened demand. Retail sales declined by 5.9% in November – the worst monthly performance since May.

Last week featured a string of tightening moves by several central banks. The Fed, the Bank of England, the European Central Bank and the Swiss National Bank all lifted their benchmark policy rates by 50bp and reiterated their determination to combat inflation.

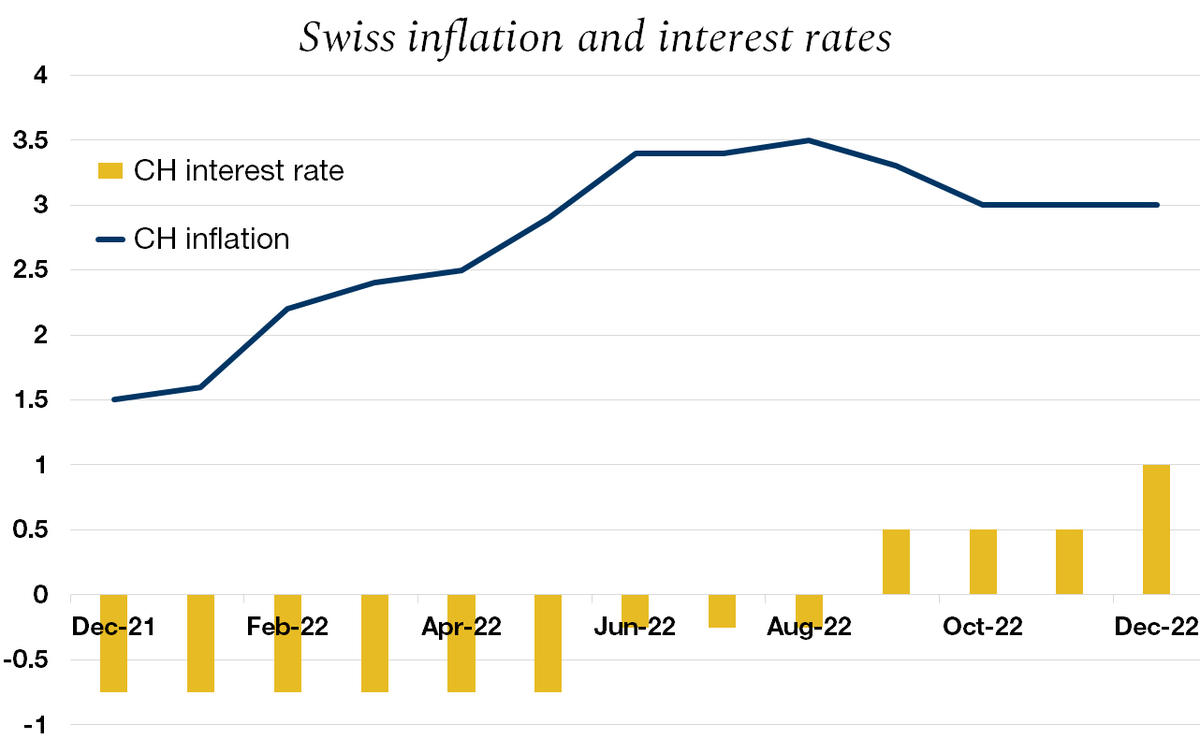

The Swiss National Bank did not spring any surprises, as it had at its September meeting, and raised its interest rate by 50bp, as was broadly expected. The strength of the Swiss franc continues to keep imported inflation largely at bay, reducing the need for too hawkish a rate move.

However, while inflation of 3% is much less worrying than elsewhere, the strength of the Swiss labour market – with unemployment at only 2% – is starting to put pressure on wages. This could subsequently create a wage-price spiral. In addition, the SNB must avoid excessive yield spreads with other countries, which would otherwise lead to speculation against the Swiss franc and encourage price increases. With this third rate hike, the SNB is sending a clear message about its intention to rein inflation in back to its 2% target.

The benchmark policy rate, which was still negative at the beginning of the year, now stands at 1%. The SNB expects inflation to attain 2.4% in 2023 and plans to continue raising rates, which we expect will peak at 1.75-2% in mid-2023. We also expect the Swiss economy to grow by around 0.7% in 2023 and 1.1% in 2024.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.