Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.93 | 0.99 | 11'144.54 | 4'017.83 | 14'610.02 | 6'860.95 | 7'699.49 | 3'895.08 | 10'569.29 | 25'973.85 | 988.68 |

| Trend | |||||||||||

| YTD | 0.36% | -0.21% | 3.87% | 5.91% | 4.93% | 5.98% | 3.32% | 1.45% | 0.98% | -0.46% | 3.38% |

(values from the Friday preceding publication)

Central banks last year switched to extremely restrictive monetary policies to counter runaway inflation, leading to corrections in both bond and equity markets. As we head into 2023, healthier inflation numbers and the prospect of the Chinese economy operating as usual have given market participants some reason for cheer.

Bond yields have eased off. The yield on the 10-year Treasury is 3.55%; its German counterpart lies at 2.20%

In the US, moderate wage inflation and the sharp downturn in the services sectors signal that the economy is losing steam. The business contraction may have slowed marginally in December but the economic outlook remains hazy. The composite PMI recovered to 49.2 in December versus 48.3 in November. But the drop in demand amid higher interest rates had a negative impact on prices paid. The ISM manufacturing index continued to decrease, dipping to 48.4 in December versus 49.0 in November. The ISM services index contracted sharply to 49.6 in December versus 56.5 in November. The increase in the average hourly wage slowed further to 4.6% year-on-year compared with a 4.8% rise in December.

Even so, the US labour market is proving resilient. Job creation as measured by non-farm payrolls was higher than expected in December at 223,000, although this was lower than in the previous month. Initial jobless claims also dropped at year-end, falling to 204,000 units versus the forecast for 225,000.

Business trends have help up in Europe while inflation continues to slow. The Eurozone manufacturing PMI recovered marginally from 47.1 in November to 47.8 in December.

German inflation ebbed further in December to 9.6% (HCPI) year-on-year versus 11.3% in November. In France, this same price index slowed to 6.7% year-on-year in December (versus 7.2% forecast) compared with 7.1% in November.

Producer prices fell by 0.9% month-on-month in November but were still 27.1% higher on a 12-month basis. Excluding energy, producer prices increased by 0.1% month-on-month and 13.1% year-on-year. Eurozone energy prices fell by 2.2% in November after a sharp decline of 7.4% in October, but were still up 55.7% year-on-year.

In China, manufacturing activity contracted at a faster pace in December as rising Covid infections disrupted production and dampened demand. In contrast, the lifting of pandemic-related restrictions and the prospect of a return to normal in the Chinese economy drove indices even higher. The Hang Seng Index has rebounded by more than 45% from its late-October low.

The first financial reports this week could deliver more visibility about the trend for corporate earnings.

After 3 years of total isolation, China has at last reopened its borders and ended the lockdown measures arising from its zero-covid policy, which has damaged the world’s second-largest economy and kindled a mood of discontent among the population, leading to several demonstrations up and down the country.

On 8 January, the Chinese government lifted quarantine requirements for travellers, thus opening the frontiers between different regions and with the rest the world. This momentous decision – taken just ahead of the Chinese New Year – comes as a welcome relief. People will now be able to circulate around the country to celebrate with their families. Travelling connected with the Chinese New Year represents the biggest population movement in the world, with 2 billion journeys planned over the space of a month. No wonder the travel industry is smiling.

The news was cheered by the market, especially by consumer discretionary and luxury stocks, with LVMH and Adidas gaining more than 10%. Consumer spending is expected to pick up and drive growth once again. The easing in lockdown measures comes on top of the government’s support for the property sector aimed at galvanising the domestic economy.

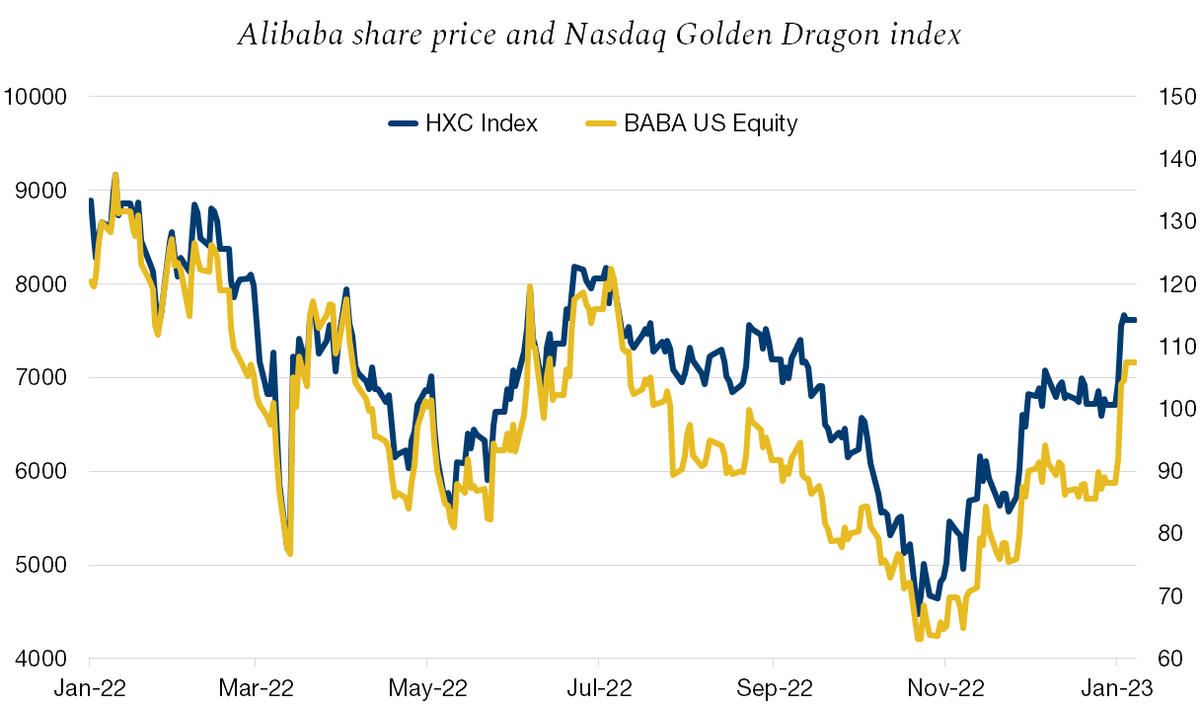

Separately, the authorities have approved the recapitalisation of the financial wing of Alibaba, which has consequently raised USD 1.5 billion, reviving hopes for a more flexible approach from the government to the country’s tech giants. The Alibaba share price is up 22% year to date. The Nasdaq Golden Dragon tech index has gained 14%.

This ending of restrictions after 3 tough years casts a positive aura over Chinese stocks, which is good news for the global economy too.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.