Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.93 | 0.98 | 11'068.30 | 3'942.62 | 14'370.72 | 6'677.64 | 7'476.63 | 3'934.38 | 11'004.62 | 27'901.01 | 978.28 |

| Trend | |||||||||||

| YTD | 2.48% | -5.08% | -14.04% | -8.28% | -9.53% | -6.65% | 1.25% | -17.45% | -29.66% | -3.09% | -20.59% |

(values from the Friday preceding publication)

Risk aversion resurfaced last week, triggering a sharp downswing in equity markets as market participants questioned whether the pace of the Fed’s monetary tightening would actually slow down following the release of macroeconomic data undermining the prospect for lower inflation.

Bond yields edged up last week, with the US 10-year yield back at 3.50% and the Bund at 1.90%.

In the US, economic activity remains buoyant as testified to by the ISM Services index for November, which clocked in at 56.5 – beating the forecast for 53.5.

In a similar vein, the Producer Price Index (PPI) rose by 0.3% month-on-month in November, having gained by the same percentage in October. Year-on-year, however, the increase slowed down to 7.4%, down from 8.1% in the previous month.

In the US labour market, jobless claims rose last week to 230,000, an increase of 4,000 from the previous week. The four-week moving average advanced to 230,000, which is 1,000 more than the previous week, signalling slowing hiring trends.

The number of people receiving regular benefits increased by 62,000 to over 1.67 million in the week ending 26 November.

In Europe, Germany’s industrial production was sturdy in October, edging down by only 0.1% after rising by 1.1% in September. Third-quarter GDP in the Eurozone expanded by an annualised 2.3%, above expectations for a 2.1% increase.

The S&P 500 ended the week down sharply by 3.37% while the tech-heavy Nasdaq, more sensitive to interest rate expectations, tanked by 3.99%.

In China, the authorities are speeding up reopening to boost economic growth and prevent further unrest up and down the country. Several large cities are no longer requiring covid test results for residents to use public transport or areas. Although the lockdowns are only partially lifted so far, we expect these relaxations will restore consumer confidence.

The markets will this week focus on central banks news and the US consumer price index.

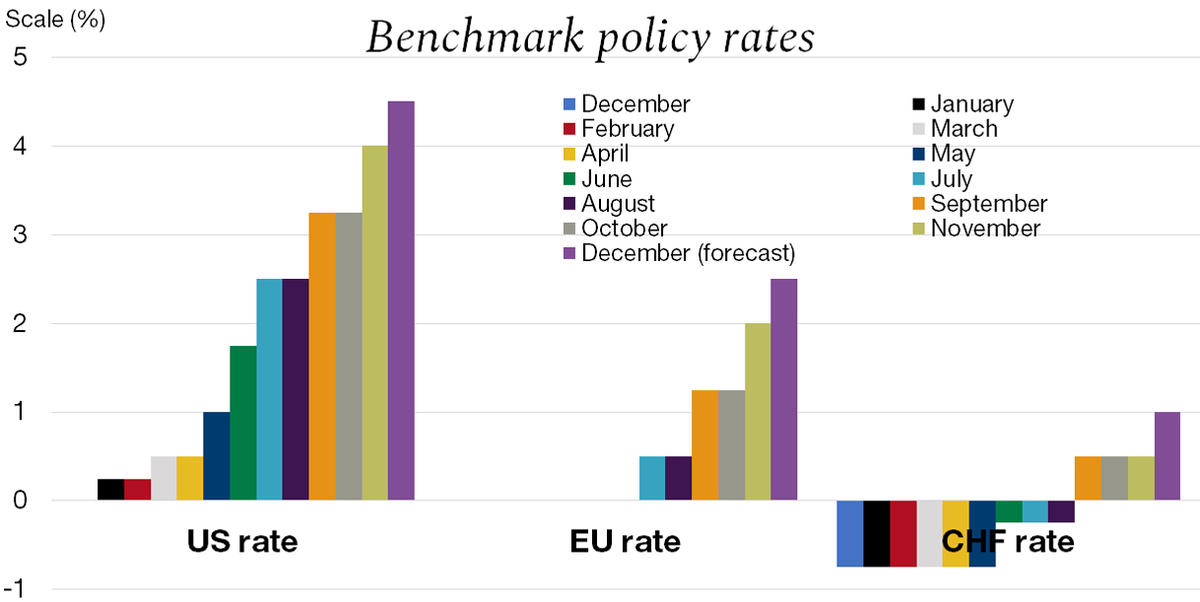

The agenda for this second week of December is dominated by the central banks. The Fed will announce its policy decision on Wednesday, and the SNB followed by the Bank of England and the ECB will be doing the same on Thursday. These meetings will at last give us hints as to whether central banks will slow the pace of rate hikes in 2023, plus provide the final values for end-2022. The main event this year has been the tightening of borrowing conditions orchestrated by central banks as they sought to curb inflation, which has gradually become entrenched at the expense of economic growth. So far, the effects of the restrictive policies pursued by central banks are not properly materialising in the real economy.

In the US, despite seven rate hikes in 2022, the strength of the labour market remains intact, and wage increases continue to support consumer spending. The Fed is therefore expected to continue hiking rates on Wednesday, with a 0.5% tightening move expected.

The energy crisis continues to pile pressure on the European economy. The Eurozone, hard hit by the war in Ukraine and the ensuing sanctions, is suffering from inflation standing at a massive 10% in October. Despite its best efforts, the deterioration in the European economic picture and political tensions put the ECB in a delicate position if it were to enact an overly restrictive monetary policy. The risk of a recession is deadly serious. Even so the market has priced in a rate hike of +0.5% on Thursday.

In Switzerland, things are quite different, as the SNB’s ‘strong franc’ policy has kept imported inflation in check. We see the policy rate peaking at 1.75-2.0% in this cycle.

For the time being, central banks remain undaunted. The continued tightening in policy over the coming months is likely to produce peak rates around mid-2023. As a result, global growth is expected to slow sharply next year and might even shift into the red, which would spell the end of restrictive monetary policies in tandem with a fallback in prices.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.