Analyse June 2023

Shift away from dollar in global economy

Video produced in collaboration with Le Temps

The waning power of the dollar is a recurring theme these days. What are the driving forces behind this apparent trend?

As we write, the dollar is the most widely used currency in global trade and financial asset movements. But some observers now believe that its dominant position in the global economy could be undermined in the not-too-distant future.

To understand why the dollar is indeed so dominant, we need to look back in time to see what has happened, especially on the political front.

For more than a century, the US has been the world’s largest economic force and, since the end of the Second World War, the foremost military power. These two factors make the dollar both a haven and a reserve currency.

Central banks hold huge dollar reserves to hedge against currency fluctuations and political risks. The size of the US bond market, by far the most liquid in the world (over USD 50 trillion), makes it easy to invest and withdraw large sums of money.

Cross-border trade in virtually all commodities, especially oil, is conducted in dollars, even if the parties to the trade are not American. In 2022, the dollar was instrumental in 88% of all transactions in the foreign exchange market, which is the largest financial market in the world according to the Bank for International Settlements.

But the dollar’s dominance may not last forever. Many countries are actively working to reduce their reliance on the greenback, mainly because of the use of dollar-related sanctions for political purposes. It is not unknown for the US to use the dollar as a weapon, imposing sanctions on companies and countries that are out of line with its foreign policy. A company or bank hit by US sanctions will not be able to transact in dollars, which may result in huge barriers to cross-border business.

“Dedollarisation”, to give the process its technical name, therefore means reducing reliance on the dollar as a medium of exchange.

Today, more than half of the global population lives in a non-democratic country. As such, vast swathes of the planet are governed by rules that are not in line with American values, potentially exposing such countries to sanctions.

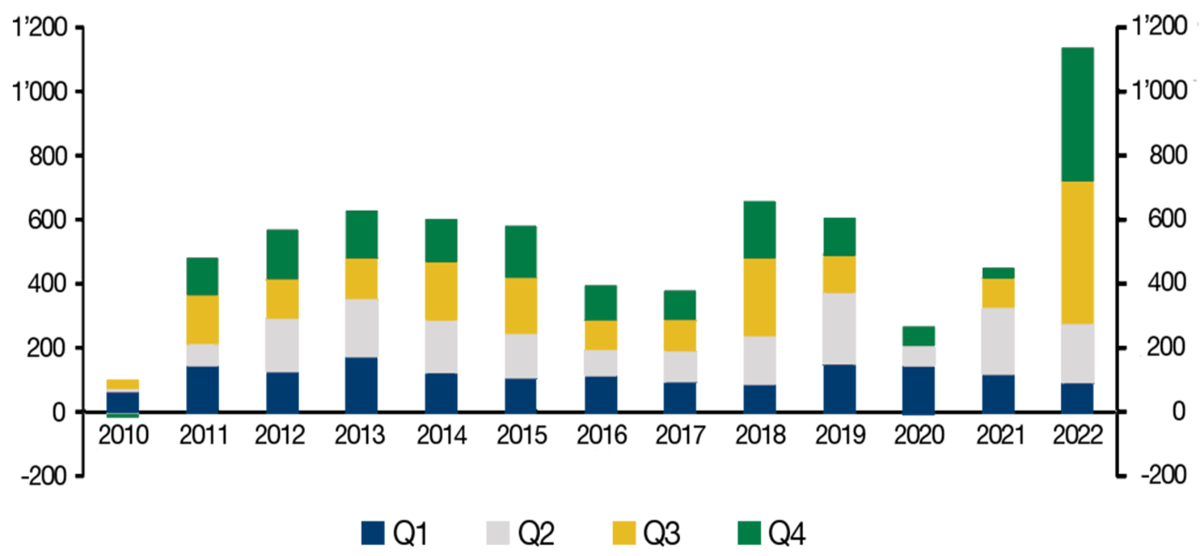

Gold making a comeback

Several central banks are diversifying their assets, often by buying gold. In 2022, gold purchases jumped 150% to 1,136 tonnes compared with 500 tonnes a year in the previous 12 years. As well as a hedge against inflation, gold is also a way of circumventing dollar-linked sanctions. Russia is a case in point. After Russia invaded Ukraine, Western countries cut it off from the global financial system by freezing USD 300 billion of its central bank’s assets held by various institutions around the world. But Russia’s gold reserves were untouched because they are held domestically.

China bought a total of 62 tonnes of gold in November and December 2022 and now has more than 2,000 tonnes in its vaults (equivalent to CHF 115 billion). Similarly of note, Turkey’s gold reserves stand at 542 tonnes.

China is a driving force behind dedollarisation. Some of its main oil suppliers are under US sanctions (Russia, Venezuela and Iran), meaning that Beijing has to use currencies other than the dollar for settlements. In 2018, China launched its own commodities exchange. Although the trading volume on this platform so far represents only 5% of global volumes, the medium of exchange is renminbi.

Brazil also wants to pay for its purchases from China in renminbi and is encouraging other emerging economies to jump on the bandwagon.

But despite these initiatives and central banks’ efforts to diversify their asset base, the dollar remains dominant. This is due to a lack of alternatives. The renminbi (also known as the yuan, the unit of account for the currency) could one day be a candidate, given the growing importance of the Chinese economy. However, the Chinese legal system is not considered safe by foreign investors. As for cryptocurrencies such as Bitcoin and Ethereum, they represent only a tiny part of the global financial system.

So despite efforts by some countries to reduce their reliance on the dollar, it is likely to retain its dominant position for many years to come.

Central bank gold purchases between 2010 and 2022

Latest news from the Bonhôte Group

Jacques Despont

Jacques joins our client management team at our Lausanne branch after more than 30 years with a leading name in the industry.

He holds a Swiss Federal Diploma in Investment Advisory, the Swisscanto Insurance Certificate and CWMA certification (SAQ).

Jessica Cianchetta

Jessica joins Bonhôte as a wealth manager and will be part of the client management team at our Neuchâtel head office.

She is SAQ certified and has over a decade worth of experience in banking. She is currently completing her studies at the Haute-Ecole Arc in Neuchâtel.

Alan Roura picks Simon Koster as co-skipper

The crew sailing the IMOCA Hublot in the 2023 season will be Swiss through and through, following Alan Roura’s decision to team up with Zurich native Simon Koster.

The duo finished eighth when they crossed the finish line in Brest on the fourth Guyader Bermudes 1000 Race on 12 May, marking their first competitive outing together.

Analyse

Analyse