10/10/2022

Flash boursier

Key data

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.99 | 0.97 | 10'308.57 | 3'375.46 | 12'273.00 | 5'866.94 | 6'991.09 | 3'639.66 | 10'652.40 | 27'116.11 | 897.74 |

| Trend | |||||||||||

| YTD | 9.06% | -6.59% | -19.94% | -21.47% | -22.74% | -17.98% | -5.33% | -23.64% | -31.91% | -5.82% | -27.13% |

(values from the Friday preceding publication)

US job figures dampen hopes

Equity markets started the final quarter of the year slightly on the up earlier in the week as encouraging macroeconomic data led to a sharp fallback in risk aversion. But then came Friday’s US job figures, which dashed all hopes of a hiatus in the Fed’s tightening process.

Bond yields are back at highs after easing considerably in the initial part of the week. The US 10-year yield was ultimately stable over the week, clocking in at 3.88% after previously ebbing to 3.55%. The US 2/10-year spread remained at around 45 basis points (bp). As we can see, the inflationary outlook is keeping yields high.

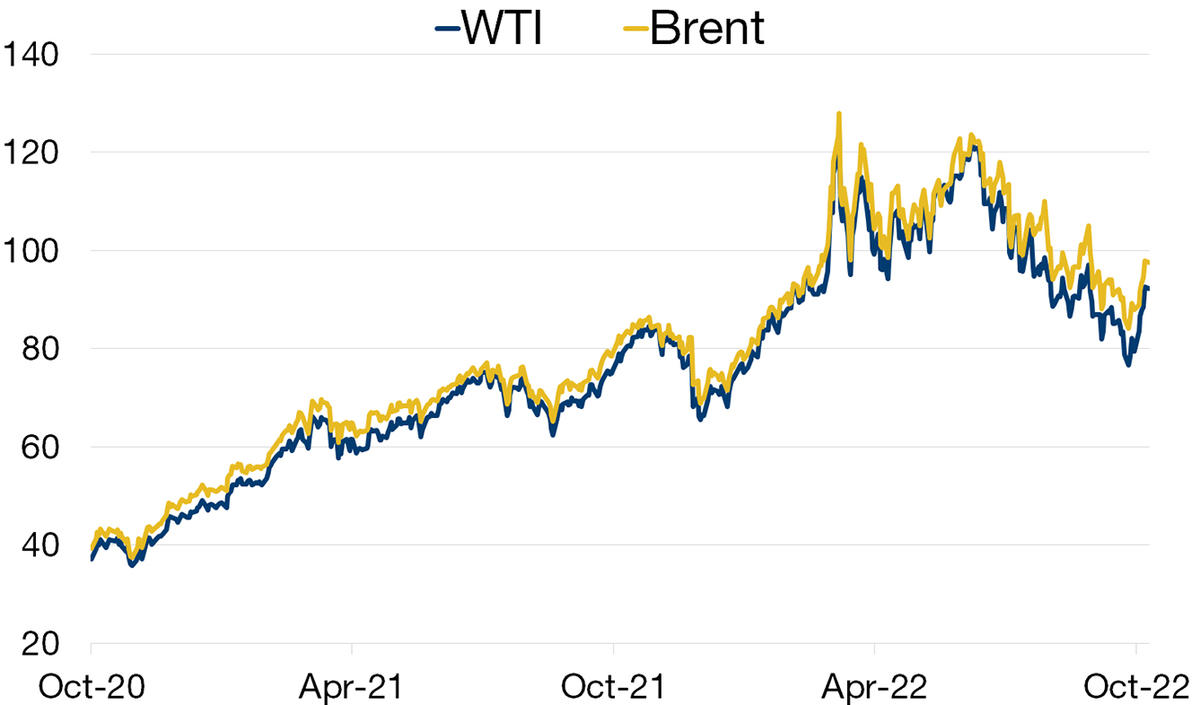

In the oil market, following the announcement by OPEC+ that it would be cutting daily output by 2 million barrels, WTI rose from below USD 80 at the end of September to above USD 92. Brent crude oil recovered by nearly USD 10 to trade at USD 98.

Against this backdrop of economic turmoil, the US labour market has started showing signs of slowing down. Initial jobless claims for the week ending 1 October advanced to 219,000, exceeding the forecast 204,000. Further to that, the number of job vacancies at the end of August fell to 10,053,000 from 11,170,000 one month earlier, showing that the slowdown in US economic growth is beginning to impact companies. In contrast, non-farm payrolls (NFP) for September, released on Friday, remained strong at 263,000 versus the 255,000 expected. The addition of 288,000 private-sector jobs was also announced last week versus the 275,000 expected, while the unemployment rate remained at its low of 3.5%. All these figures late last week drove fears that monetary policy will continue in its current shape and form.

The ISM Manufacturing PMI for September clocked in at 50.9 versus the score of 52 expected. The new orders component gave up ground to stand at 47.1 versus the 50.5 expected. The services sector clocked in at a strong 56.7 versus the 56 expected.

In Europe, the manufacturing PMI for September dipped to 48.4 versus the 48.5 expected, as did the services PMI, which stood at 48.8 versus 48.9, amid the energy crisis and the impact on economic activity.

Volatility is expected to remain high in the short term. This week will also be marked by the release of a flurry of US statistics, together with central banker speeches and the release of minutes from the last Fed meeting. For equities, the upcoming US corporate reporting season might provide a little more visibility on the coming quarters.

Surge in oil prices

Oil prices once again flirted with USD 100 a barrel after a week of consecutive gains triggered by the OPEC+ production cuts.

The oil market was today hit by some profit taking in the early part of the session, with Brent crude trading at USD 97.25 and US light crude (WTI) at 92.05. On Friday, by contrast, these had peaked at USD 97.92 and USD 92.64, respectively – levels not seen since late August.

The sudden rise in oil prices was sparked by OPEC and its associates, which last Wednesday announced that they would reduce supply by a combined 2 million barrels per day. Prices have risen in the face of production that is already limited by European sanctions on Russian oil. The US jobs report, released on Friday, was not the kind of news to lead oil prices lower either. A robust jobs market implies continued demand for energy; and with winter just around the corner, these tensions are likely to continue unabated.

The OPEC+ decision was a diplomatic slap in the face for President Biden, who is set on curbing inflation and pump prices in the US ahead of midterm elections in November. With the depletion of strategic reserves plus refinery outages in California and the Midwest, America’s room for manoeuvre has narrowed. US petrol prices jumped further to USD 3.747 per gallon last week, which was 18% higher than 12 months ago.

Sadly this pressure on oil prices is likely to continue under the impetus of several factors: the sanctions against Russian gas in Europe, the continuing decline in US stockpiles, the refinery strike in France and the OPEC+ production cut. USD 100 per barrel is a real prospect in this context.

Flash boursier

Flash boursier