Are you interested in economic and financial news?

Bank Bonhôte is pleased to welcome you and puts at your disposal its finance experts.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.08 | 11'817.20 | 4'158.51 | 15'531.75 | 6'638.46 | 7'051.48 | 4'455.48 | 15'047.70 | 30'248.81 | 1'265.10 |

| Trend | |||||||||||

| YTD | 4.43% | 0.20% | 10.40% | 17.05% | 13.22% | 19.58% | 9.15% | 18.62% | 16.75% | 10.22% | -2.03% |

(values from the Friday preceding publication)

Despite heading south at the beginning of the week, equity markets gradually regained ground, holding on to gains as central banks decisions came and went. Investors are increasingly incorporating a broad slowdown in accommodative measures. Norway’s central bank has been the first to take action, raising its benchmark policy rate to 0.25%. Canada and New Zealand are soon expected to follow suit.

Meanwhile, the Fed last week dashed expectations for hard news on tapering. Chair Powell continues to prepare the markets, having hinted that moderation in asset purchases could be announced at the next meeting in November. The so-called Fed ‘dot plot’, which charts the views of individual FOMC members on interest rate rises, shows that 9 out of 18 governors now think that the rate lift-off will take place in 2022, followed by three increases in 2023 and 2024. That suggests a benchmark rate of 1.75% in three years’ time. This different prospect is also driven by latest forecasts for inflation, which they see peaking at 4.2% this year, i.e. more than twice the target. The Fed also cut its annual GDP growth forecast to 5.9% (from 7% in June).

Yields have risen since the policy statement. Expect more volatility in the bond market during the final quarter.

China continues to constrain markets with each government crackdown. The latest is taking on cryptocurrencies. Beijing is tightening its grip on cryptocurrency trading platforms in a bid to eliminate the illegal business that arises from cryptocurrency exchanges. Bitcoin mining is now banned nationwide, as are the cryptocurrency-related services offered by banks and payment providers.

Evergrande has already rattled investors, and more of its payment deadlines are looming this week. Since the scandal broke, the Chinese government has injected nearly 461 billion yuan (61 billion euros) to reassure the market. ECB President Christine Lagarde has stated that European exposure is limited.

Global growth is losing momentum, as are equity market indices, which have not risen for the past month. Bear in mind that over a 10-year period, the S&P 500 has put on 388%, or an annualised 17%. Expectations today are consequently high, making it is increasingly difficult to surprise on the upside. Stock indices need to find their second wind in the final quarter, potentially blowing across from nine-month corporate earnings.

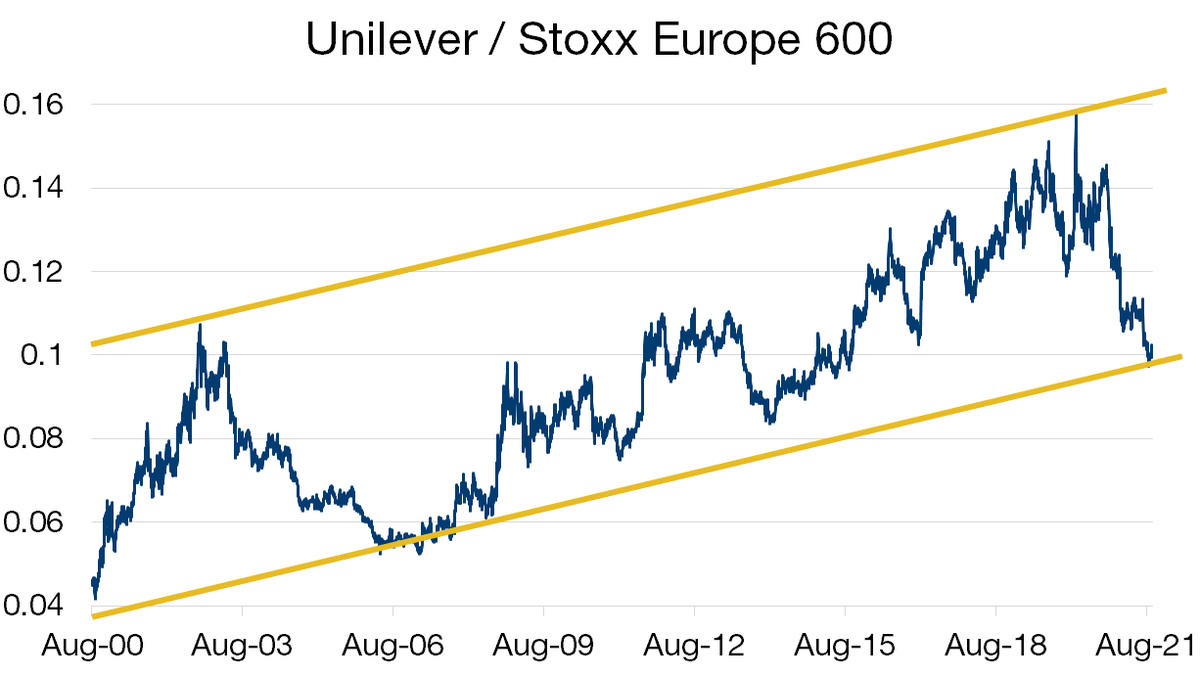

In an equity market that is seemingly running out of steam and widely exhibiting rich multiples, it is worth considering not the absolute share prices but rather their level relative to their benchmark. By comparing the price of a stock to its index, we gain a view of its over- or under-performance against the broad market.

Unilever is one of the world’s leading companies in the personal care, household and food segments (including beverages and ice cream). Its P/E is lower than that of its competitors. It trades at a 25% discount to Nestlé. The dividend is attractive, with the latest yield at 3.7%.

On technicals, as the chart opposite shows, Unilever’s price relative to the pan-European index currently lies at the bottom end of a long-term channel. This ascending channel is also the indication that in the long run, Unilever has tended to outperform the market. Reverting to midrange in the channel would equate to outperformance of more than 30% versus the pan-European market. Moreover, the consumer goods sector to which Unilever belongs is generally defensive. In current conditions, then, the stock seems attractive for long positions where it is trading.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.