Interessieren Sie sich für Finanz- und Wirtschaftsnachrichten ?

Die Bank Bonhôte heisst Sie herzlich willkommen und stellt Ihnen Ihre Finanz-Experten gerne zur Verfügung.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.06 | 12'108.17 | 4'250.56 | 15'688.77 | 6'830.34 | 7'237.57 | 4'605.38 | 15'498.39 | 28'892.69 | 1'264.75 |

| Trend | |||||||||||

| YTD | 3.41% | -2.13% | 13.12% | 19.65% | 14.36% | 23.04% | 12.03% | 22.61% | 20.25% | 5.28% | -2.05% |

(values from the Friday preceding publication)

October largely offset September’s drawdown as many stocks swung back to soldier on to new record highs. The tech-heavy Nasdaq jumped 7.5% to its highest all-time reading, and the pattern is similar for other equity markets. Profitability stands at an all-time high among US corporations while mass buyback programmes are expected to continue supporting share prices. Towards the end of the week, investors shrugged off disappointing results from Apple and Amazon – hit respectively by supply bottlenecks and labour costs – and their cautious forecasts for the holiday season. All in all, more than 80% of the S&P 500 companies that have reported have topped consensus forecasts, although figures have shown signs of rising energy prices and hiring difficulties starting to weigh on margins.

Equity markets are off to a firm start this month, helped by the outcome of legislative elections held in Japan yesterday. Despite losing seats, the current ruling coalition made up of Liberal Democratic Party and the Komei Party has retained its majority, marking a vote of confidence in the government run by PM Fumio Kishida.

From the Fed’s meeting terminating on Wednesday, the market is expecting news that it will taper purchases of ordinary and mortgage-backed bonds. The tone adopted regarding the fleetingness of inflation will also be crucial. According to futures markets, two 25bp increases in short-term rates are in the works for 2022. Meanwhile the US yield curve is flattening as 30- and 10-year rates decline and 2-year rates head upwards. While lower long-term yields are generally seen as positive for risk assets, the relationship is more complicated in the current setting, in which inflation fears are mingling with signs of slowing economic growth. Just look at US GDP, which grew by only 2% in the third quarter on an annualised basis – the slowest performance this year. The sharp slowdown relative to the 6.7% chalked up in the second quarter was due in particular to less spending on durable goods, which is estimated to have shaved 2.7 points from economic growth.

Across in Europe, GDP grew by 2.2% in the third quarter while the inflation quickened to 4.1%, twice the ECB’s official target.

The end of ‘peak monetary stimulus’ among major central banks may coincide with a less dynamic rate of economic expansion.

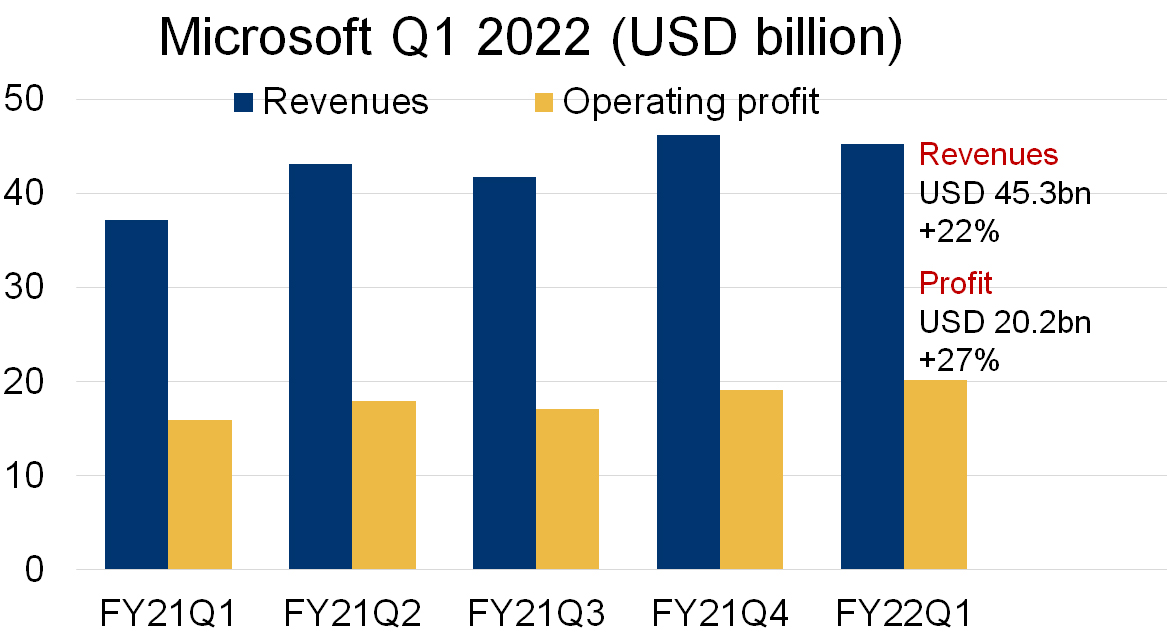

For its first quarter of its 2022 financial year, Microsoft reported better-than-expected results in all business segments, from business cloud services to its Windows operating system.

Revenues totalled USD 45.3bn, moving up 22% compared with the same period in the previous year. Operating profit shot up by 27% to USD 20.2bn. Microsoft has continued to surf the wave of rising demand from both enterprise customers and retail consumers.

The acceleration was especially notable at the Azure cloud division. In more retail-oriented businesses, revenues from personal computing also made significant progress, with revenues from Windows rising by an unexpected 10% compared with the same quarter last year, and in video games, demand boomed for the Xbox series. This brisk growth looks sustainable as many companies of all sizes switch to the infrastructure, productivity and security solutions required for them to move fully into the digital age.

Microsoft is progressively gaining market share, helped by a wide range of products and strategic partnerships.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.