Interessieren Sie sich für Finanz- und Wirtschaftsnachrichten ?

Die Bank Bonhôte heisst Sie herzlich willkommen und stellt Ihnen Ihre Finanz-Experten gerne zur Verfügung.

| USD/CHF | EUR/CHF | SMI | EURO STOXX 50 | DAX 30 | CAC 40 | FTSE 100 | S&P 500 | NASDAQ | NIKKEI | MSCI Emerging Markets | |

| Latest | 0.92 | 1.04 | 12'715.48 | 4'161.35 | 15'531.69 | 6'926.63 | 7'269.92 | 4'620.64 | 15'169.68 | 28'545.68 | 1'216.30 |

| Trend | |||||||||||

| YTD | 4.41% | -3.96% | 18.80% | 17.13% | 13.21% | 24.77% | 12.53% | 23.02% | 17.70% | 4.01% | -5.81% |

(values from the Friday preceding publication)

Last week marked the final policy meetings for the year by central banks. The Fed responded to the unrelenting inflationary pressure by stepping up the rate of tapering so that monthly asset purchases would be wound up by March not June 2022, as was initially scheduled. Members of its policy committee are unanimous that rates need to rise sooner rather than later, and so they expect three rate hikes as early as next year. But they believe that keeping rates low until full employment is achieved again is also vital, so that growth does not suffer further, having already taken multiple hits from coronavirus variants with perhaps more in store.

The Swiss National Bank (SNB), when it met, left its policy unchanged. Rate setters there expect Swiss GDP growth to clock in at 3% and inflation at 1% in 2022. Meanwhile, the European Central Bank (ECB) as expected held rates and will continue snapping up assets until March. In 2022, it sees inflation peaking at 3.2% then levelling off. Christine Lagarde stated that a rate hike next year was highly unlikely, but she also wants to keep her options open. The surprise came from the UK, where the Bank of England (BoE) nudged up its base rate to 0.25% to combat runaway inflation.

Central banks are steadily returning to more orthodox postures while keeping interest rates low relative to equilibrium levels as they seek to prevent their economies from overheating and hoisting inflation too high, or from contracting too sharply and creating deflation. Abrupt rate hikes can be ruled out, especially as inflation is likely to subside anyway as pandemic-driven distortions in supply chains are resolved.

The prospect of tightening comes as no surprise as this support was always going to be withdrawn once the economic recovery was on track. To sustain growth, however, consumer spending needs to pick up pace in 2022 to support actual business profits. US households are widely expected to spend the money saved up during lockdowns, thereby reducing the currently high savings ratio to pre-pandemic standards.

If we look at macroeconomic indicators, we see that US initial jobless claims rose to 206,000 in the last week, while industrial production improved for the second consecutive month. Supply bottlenecks left their mark recently in terms of lower retail sales, although these were 20% above pre-pandemic levels.

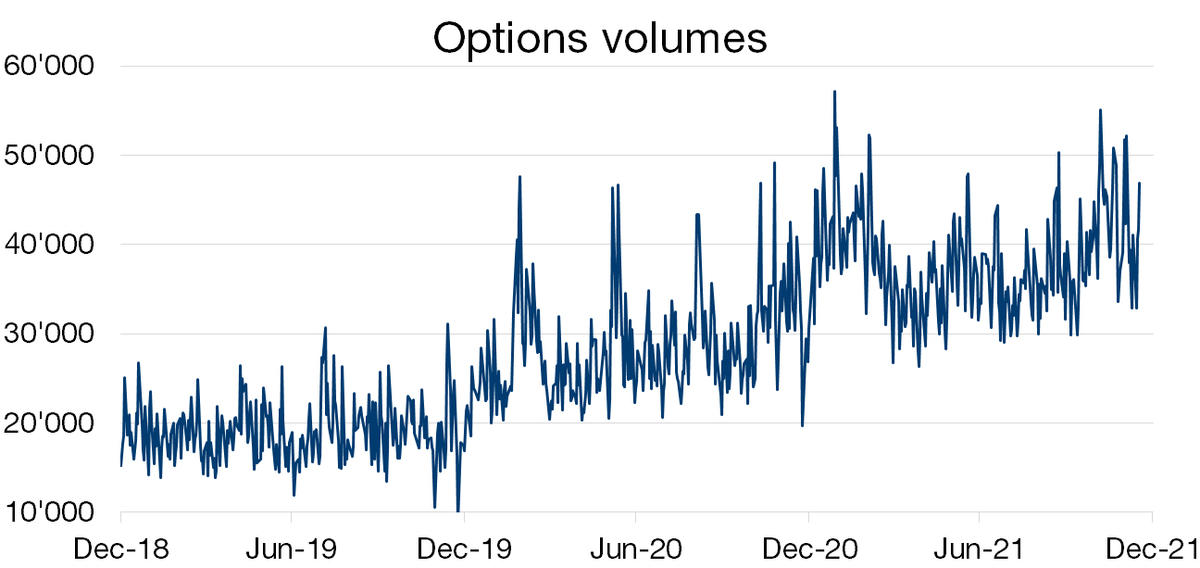

Market volatility is being worsened by shifts in investment style resulting from the impending rate hikes and the significant volumes associated with options contracts. This year may have been great overall for equity indices, but a wide disparity exists among the companies that are part of them.

For some time, equity indices have been on a rollercoaster, obscuring our view as to what is happening below the surface. The rising divergence in terms of individual share performances, driven even higher by the booming options business and the Fed’s more hawkish tone, could undermine many investors’ positions.

But a closer look at indices reveals that happenings beneath the surface are by no means a reflection of their headline performances. The S&P 500 has put on 23% this year, but over 210 index members are quoting at least 10% below their peak 12 months earlier.

For the tech-heavy Nasdaq, this observation is even more poignant. Over 1,300 shares have lost 50% of their value relative to their 2020 high point. There is a total disconnect between stocks and this is reflected in the performance of active fund managers, who are struggling to beat their benchmarks. The S&P 500 is moreover heavily influenced by the performance of five big tech giants (Apple, Microsoft, Google, Tesla and Nvidia), which have accounted for more than half of the index’s performance since April. One day recently, the entire market lurched down but Apple gained – illustrating the power of these household names over the leading US index, which ended the session marginally in the green despite the broad-based decline. Additionally, the volume of options trades has risen in recent months. So far this month, over 50 million option contracts have been traded in the US. These lofty levels are worsening market fluctuations, which in turn is triggering distortions among various stocks.

Download the Flash boursier (pdf)

This document is provided for your information only. It has been compiledfrom information collected from sources believed to be reliable and up to date, with no warranty as to its accuracy or completeness.By their very nature, markets and financial products are subject to the risk of substantial losses which may be incompatible with your risk tolerance.Any past performance that may be reflected in this documentis not a reliable indicator of future results.Nothing contained in this document should be construed as professional or investment advice. This document is not an offer to you to sell or a solicitation of an offer to buy any securities or any other financial product of any nature, and the Bank assumes no liability whatsoever in respect of this document.The Bank reserves the right, where necessary, to depart from the opinions expressed in this document, particularly in connection with the management of its clients’ mandates and the management of certain collective investments.The Bank is a Swiss bank subject to regulation and supervision by the Swiss Financial Market Supervisory Authority (FINMA).It is not authorised or supervised by any foreign regulator.Consequently, the publication of this document outside Switzerland, and the sale of certain products to investors resident or domiciled outside Switzerland may be subject to restrictions or prohibitions under foreign law.It is your responsibility to seek information regarding your status in this respect and to comply with all applicable laws and regulations.We strongly advise you to seek independentlegal and financial advice from qualified professional advisers before taking any decision based on the contents of this publication.