Analyse April 2024

Workers facing opportunities but also challenges from AI

Video produced in collaboration with Le Temps

Among today’s technological innovations, artificial intelligence (AI) is emerging as a key transformative force with potential to disrupt the world of work.

The possibilities are endless, some say. Others are more preoccupied by the unprecedented challenges that are emerging. Whatever we think, AI is going to impact productivity and people’s jobs in the future. The question is how.

It would be extremely hard to forecast how quickly AI is going to make inroads into the economy, and what this will look like, given the sheer difference of expert viewpoints on the trajectory that it will take. So rather than getting ahead of ourselves, we should simply analyse the current picture as free from bias as possible and repudiate any speculation that would otherwise warp our judgement. Instead we should focus simply on the future risks and challenges.

Needless to say, AI-driven automation is redefining job profiles. This is forcing some to evolve or even disappear altogether. At the same time, demand for new skillsets is emerging. Academia has yet to perceive any real lasting damage on overall demand for labour. However, certain specialisations – particularly visual and written content creation – are already feeling the effects. Research also suggests that AI could narrow the productivity gap between workers with different skillsets.

Thin line between job creation and attrition

Research shows that AI is upending a whole range of business sectors, from healthcare and finance to manufacturing. Cutting-edge technology of this kind has the potential to deliver huge productivity gains by automating repetitive tasks so that employees can focus on adding value. In the world of medicine, for example, AI is revolutionising patient data analysis, leading to faster and more accurate diagnosis and then to more effective, personalised treatments.

As individual companies make the transition to AI, the impact on jobs (positive or negative) is less clear. Consider, for example, a logistics company that automates its entire operations chain, from receiving the orders to shipping the goods. Admittedly, there will be less demand for logistics workers as a result, but AI will still have a positive impact on jobs by stimulating demand for maintenance and repair roles related to the new machines.

AI can also improve productivity by enabling employees to work more efficiently. Higher productivity can then reduce costs, leading to lower selling prices, which in turn could accelerate demand for a company’s goods. For semi-finished goods, the savings could be shared with other industries. The end result is a positive impact on job creation. The ultimate effect on employment therefore depends on whether companies can and want to pass on cost reductions to consumers and on how responsive demand will be to price cuts.

Here come the lawmakers

Policymakers therefore need to foster conditions in which this productivity effect can come to the fore. That can include promoting healthy competition through effective antitrust regulation so that firms are willing to pass on reductions in production costs to consumers. A dynamic labour market with low unemployment could also stimulate demand and encourage the development of new technologies. Where unemployment is low and competition for talent is high, firms are likely to invest in new technologies and encourage innovation.

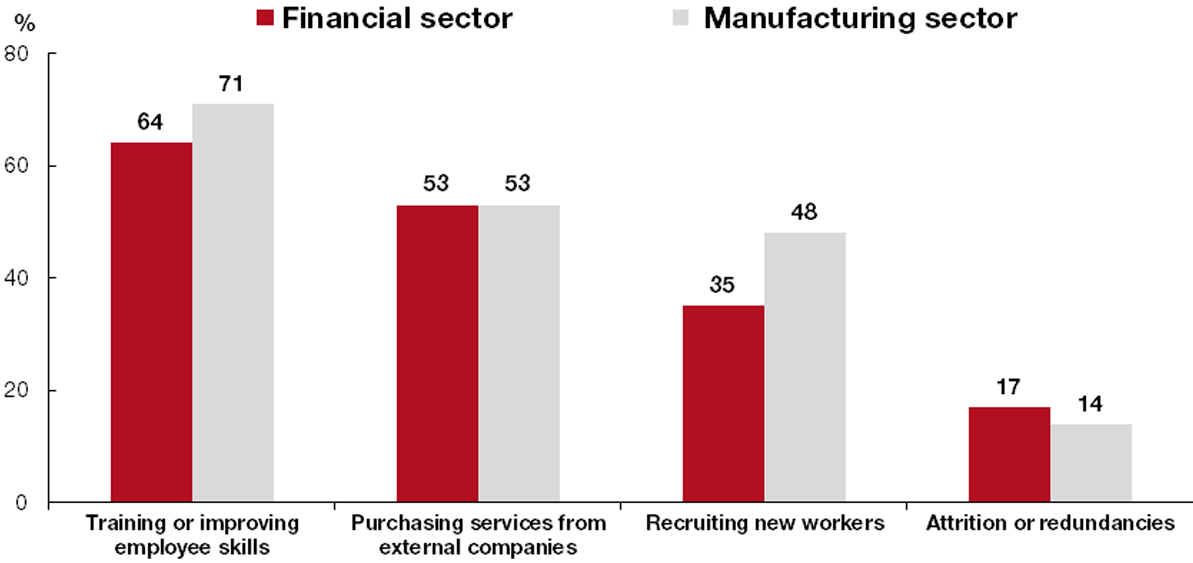

Training is also key to the successful integration of new technologies, as AI will require new skills. An under-qualified workforce is a major barrier to the uptake of AI. Legislators will therefore have an important role to play, not only in encouraging employers to retrain their staff but also because a significant proportion of the training required will have to be provided from within the education system.

The risks associated with the use of AI in the workplace, coupled with its rapid proliferation, underline the need for decisive action to develop a regulatory framework that can harness the benefits while taking into account the risks to workers’ fundamental rights and well-being. The problem is that the application of AI-related legislation remains uncertain, given the limited legal precedent in this area. It will therefore be crucial to achieve a combination of up-to-date guidelines to shape business practices and binding rules to prevent or undo the harm caused by AI.

The emergence of AI is therefore a double-edged sword for workers. At times, there will be opportunities, but there will also be threats. An appropriate regulatory framework will therefore be essential to harness the benefits of AI while mitigating its risks: not only regulation, but also education.

Investors should focus on those companies that can successfully navigate through this transition.

Employer strategies for strengthening in-house skills

Source: OECD – Employer survey on the impact of AI in the workplace (2022)

Latest news from the Bonhôte Group

Kim-Andrée Potvin appointed Chief Operating Officer

We are delighted to announce the appointment of Kim-Andrée Potvin as Chief Operating Officer (COO). Kim is a native of Canada and holds an MBA from the Université de Sherbrooke. She has more than 15 years’ experience in operational management.

We also look forward to drawing on her sustainable finance expertise to expand our ESG footprint, both in our own investments and the products we market to our clients.

Expanding AIM and discretionary management departments

Independent asset managers (IAM) are a central plank of our strategic development (see photo). Nicolas Bader and Olivier Christen recently joined this department as senior managers.

Our discretionary management service has also been strengthened by the recent appointment of Esther Halas Budinsky as Product Manager and Pascal Maire as Portfolio Manager.

New fund Bonhôte Selection – Global Bonds ESG

We recently incepted the new Bonhôte Selection – Global Bonds ESG fund, which boasts a flexible, benchmark-independent strategy.

The fund invests in a wide range of fixed-income assets, paying particular attention to ESG criteria when selecting investments.

Analyse

Analyse