Analyse April 2016

Central banks may be at their wits’ end

Governments in the developed countries have found it impossible to kick-start economic growth or, at least, shore it up by increasing their expenditure. The sovereign debt spiral that followed the 2008 financial crisis prompted investors to put pressure on public authorities, forcing them to adopt austerity measures designed to put their chaotic finances back in order.

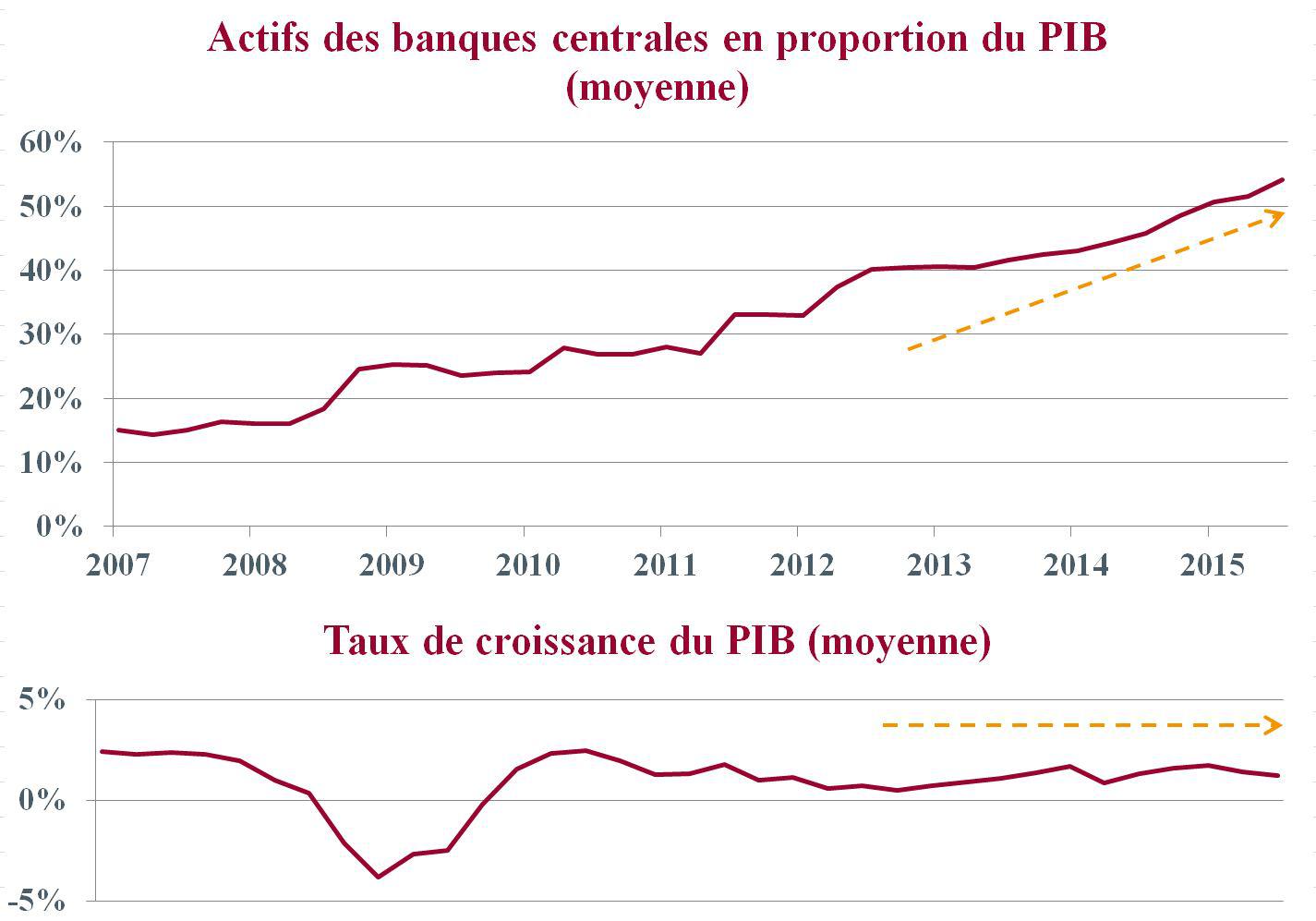

Faced with this obligation and the need to keep GDP growth in positive territory, governments turned to their central banks and asked them to replace budget stimulus with monetary stimulus (Fig. 1). In summary they realised that, since they could no longer borrow massively to cover budget deficits resulting from higher levels of state spending, they would call on their monetary authorities to provide liquidity at so little cost that companies and consumers would take out loans and mortgages, and run up their credit cards, faster than anyone could say Jack Robinson. The ensuing increase in demand, so the thinking went, would not only spur economic growth but would also lead to a moderate upturn in inflation—a windfall for anyone in deep debt.

Why isn’t it working?

The reasons why this process has failed are both structural and cyclical. First of all, to be effective monetary stimulus has to use the banking system as a drive belt. But, since 2008, the regulatory restrictions imposed on banks have grown exponentially, forcing them to reduce their balance sheets and the levels of risk they are exposed to. In these conditions it is impossible for them to expand their loan books. Moreover, since the advent of negative interest rates, the interbank lending market has dried up. Banks no longer borrow from one another because, if they do, they could find themselves with too much liquidity and have to pay negative interest on it.

This same wariness can be seen in the economy. There it is made worse by the fact that, even though money is cheap, people are reluctant to borrow more. Consumers already carry a heavy debt burden and, since they consume less as they grow older, population ageing is having an additional adverse impact. The only undeniable benefit of low borrowing costs seen recently is a pickup in the rate at which people trade in their car for a new one, so they can get a bargain leasing deal. Companies, meanwhile, are deeply uncertain about where the economy is headed. Actually they are right to be worried: business activity continues to flag and the current level of long-term interest rates prices in a protracted period of stagnation or even deflation. These are not ideal conditions for seeing a decent return on capital investment. Corporate executives therefore go on spending enough to maintain production facilities as they stand but do not want to expand them.

Finally, changes in the underlying structure of the economy, most notably with the elimination of intermediaries, sharing schemes and the promotion of local consumption, are ironically putting drag on its physical growth while providing easier access to goods and services. This transformation is also deflationary as numerous business models associated with the new trends are aimed at lowering prices.

Thus the headwinds that central banks seek to vanquish are slow growth and deflation. And, despite their extremely aggressive policies, monetary authorities are only able to reverse these gales with the utmost difficulty. However, instead of looking for other solutions, all they do is print money in ever more colossal quantities, even though it cannot be absorbed by the banking system fast enough. This approach is doomed to fail because the excess liquidity is spilling over into financial markets (Fig. 2) and creating distortions that will be unsustainable long term, such as artificially high asset valuations and the advent of negative interest rates.

All this is being done to try to provide a business cycle with no recession… Yet the economy is like a human being. It needs to breathe out as well as in. It needs both night and day. Wanting to prolong daylight indefinitely is not a winning strategy!

Graph1

Graph2

Analyse

Analyse